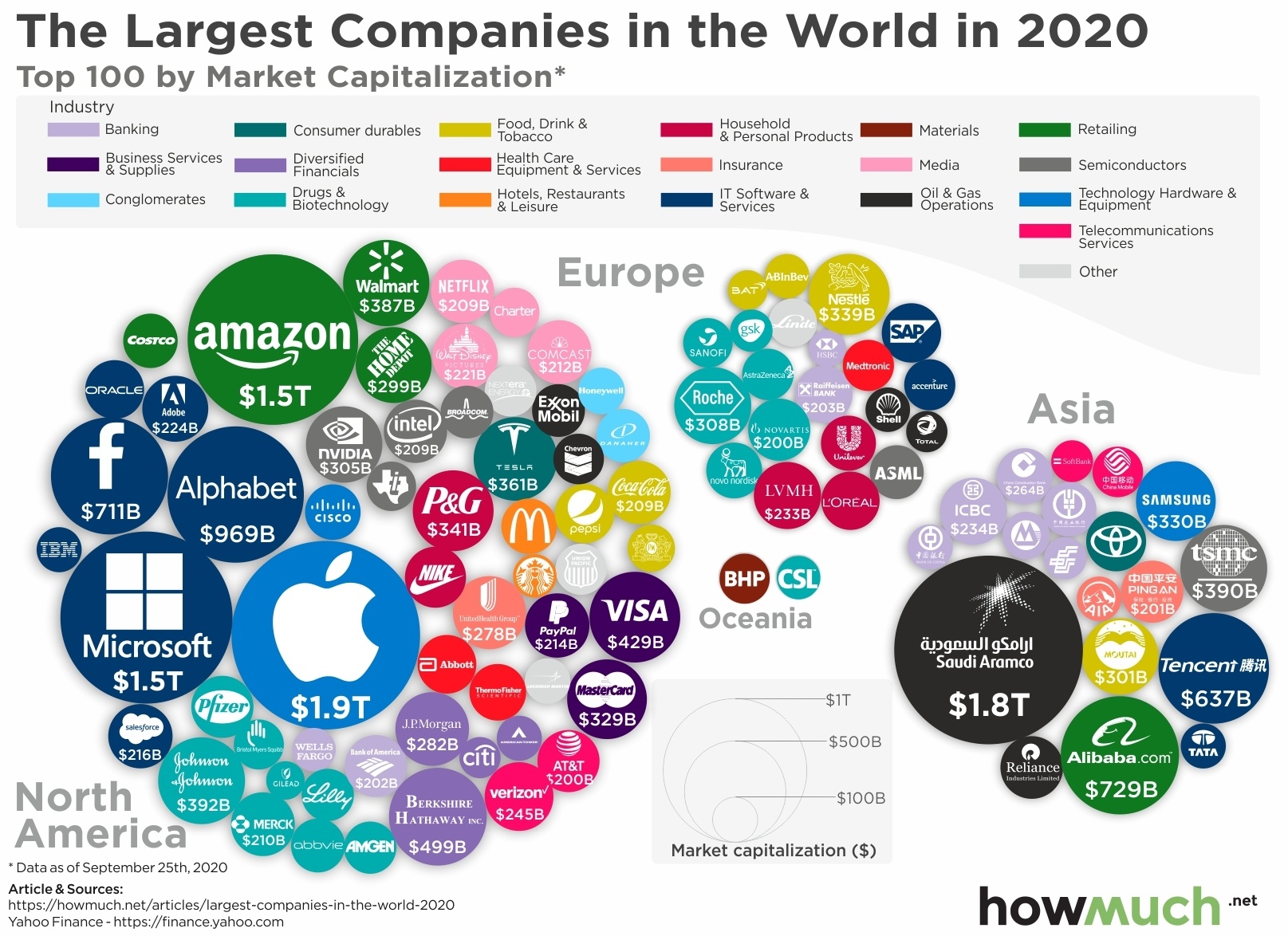

The coronavirus continues to wreak havoc across the American economy. With unemployment approaching Depression Era levels at 13.3%, it pays to have an employer with a secure business model and fat profit margins. Here are the most profitable companies on the Fortune 500 headquartered in every state around the country.

- Berkshire Hathaway remains the most profitable company on the Fortune 500. Headquartered in Nebraska, Warren Buffett’s company generated an incredible $81.4B in profit in 2019.

- 35 companies on our map saw more than $1B in profits last year. The average company made $9.4B.

- Almost every state in the country is home to at least one Fortune 500 company. The only exceptions are New Mexico, Wyoming, Montana, South Dakota, Alaska and West Virginia.

- The most profitable companies for every state from the Fortune 500 represent a variety of different industries, including insurance, oil, retail and banking.

To create our map, first we took every company on the Fortune 500 for the year 2020. Then, we figured out the most profitable company headquartered in each state, overlaying both their logos and a color-coded map of profitability. The result is a snapshot of the biggest winners in the American economy.

Top 10 Most Profitable Companies by State (2020)

1. Berkshire Hathaway - Nebraska: $81.4B

2. Apple - California: $55.3B

3. Microsoft - Washington: $39.2B

4. JPMorgan Chase - New York: $36.4B

5. Bank of America - North Carolina: $27.4B

6. Johnson & Johnson - New Jersey: $15.1B

7. Walmart - Arkansas: $14.9B

8. ExxonMobil - Texas: $14.3B

9. Fannie Mae - Washington, DC: $14.2B

10. UnitedHealth Group: Minnesota: $13.8B

There are two important caveats to keep in mind about our map. First, the Fortune 500 looks primarily at public companies. The list includes private companies only if their financial statements are readily available. It therefore excludes a lot of highly profitable but privately held companies, like Koch Industries. And second, our map only accounts for one company in each state. Facebook, Google and Apple are each from California, but there’s only room for one on our map. That being said, a remarkable insight from our map is just how diversified the most profitable companies across the Fortune 500 actually are. There are companies representing nearly every sector of the economy, including retail (Walmart, $14.9B), banking (Bank of America, $27.4B) and oil and gas (ExxonMobil, $14.3B).

Another takeaway from our map is how the majority of companies generate a lot more than $1B in annual profits. In fact, only 11 on the map turned in less than $1B, with the average across the entire visual coming in at $9.4B. The most profitable Fortune 500 company remains Berkshire Hathaway ($81.4B) in Nebraska followed by Apple ($55.3B) in California. At the other end of the spectrum, Sanderson Farms created “only” $53M in profits in Mississippi, just enough to make it onto the Fortune 500.

It’s also interesting how our map confirms the dominant players in the economy while packing a few surprises. Oregon has Nike ($4B). Apple is in California ($55.3B). Texas is home to ExxonMobile ($14.3), and there’s a few large insurance companies in the Midwest, like UnitedHealth Group in Minnesota ($13.8B) and Progessive in Ohio ($4B). The Northeast is dominated by media companies and banks like NBC Universal in Pennsylvania ($13.1B) and JPMorgan Chase in New York ($39.2B). But check out Kansas, home to Spirit AeroSpace ($530M), a major supplier for Boeing. Or what about Micron from Idaho ($6.3B), a computer memory manufacturer? Indeed, the American economy has a lot of diversity.

Are there any surprises to you on our map? And do you work at any of these companies? Let us know how you like it in the comments.

Data: Table 1.1

The petroleum industry looms large in exports for North America. According to the

The petroleum industry looms large in exports for North America. According to the  Exports look very different in South and Central America. There is a cluster of countries in Nicaragua, El Salvador and Guatemala that exports t-shirts around the world. Further to the south, countries increasingly rely on natural resources and agricultural products. Venezuela sent $23.2B of oil to foreign markets in 2018, while Brazil provided $33.2B of grains. And there are also a few obvious exports from Caribbean countries, including cigars from Cuba, yachts from the Cayman Islands and nutmeg from Grenada.

Exports look very different in South and Central America. There is a cluster of countries in Nicaragua, El Salvador and Guatemala that exports t-shirts around the world. Further to the south, countries increasingly rely on natural resources and agricultural products. Venezuela sent $23.2B of oil to foreign markets in 2018, while Brazil provided $33.2B of grains. And there are also a few obvious exports from Caribbean countries, including cigars from Cuba, yachts from the Cayman Islands and nutmeg from Grenada. Our snapshot of top exports from Europe highlights an important aspect of how developed economies work. For the most part, European countries export finished manufactured products, like automobiles, airplanes and pharmaceuticals. The continent’s leading economic power, Germany, sells about $155.7B of vehicles to the rest of the world every year. France, home to Airbus, sends abroad $43.8B in airplanes every year. Even the UK, which isn’t known for its auto manufacturing sector, exports $43.4B of vehicles.

Our snapshot of top exports from Europe highlights an important aspect of how developed economies work. For the most part, European countries export finished manufactured products, like automobiles, airplanes and pharmaceuticals. The continent’s leading economic power, Germany, sells about $155.7B of vehicles to the rest of the world every year. France, home to Airbus, sends abroad $43.8B in airplanes every year. Even the UK, which isn’t known for its auto manufacturing sector, exports $43.4B of vehicles. Our map of Asia stretches from Turkey to Japan, and there are therefore a few different stories to tell. For starters, Asia exports a lot of finished products to the rest of the world similar to Europe, but the types of manufactured goods and underlying industries are different. China alone sends over $223B of electrical machinery around the world on an annual basis. Saudi Arabia’s oil industry is predictably off the charts, topping $164.8B each year, or about $30B more than Russia. Perhaps most surprisingly, petroleum is the top export for both India ($41.5B) and Myanmar ($5.6B). Clearly there’s a lot of economic diversity across such a large continent.

Our map of Asia stretches from Turkey to Japan, and there are therefore a few different stories to tell. For starters, Asia exports a lot of finished products to the rest of the world similar to Europe, but the types of manufactured goods and underlying industries are different. China alone sends over $223B of electrical machinery around the world on an annual basis. Saudi Arabia’s oil industry is predictably off the charts, topping $164.8B each year, or about $30B more than Russia. Perhaps most surprisingly, petroleum is the top export for both India ($41.5B) and Myanmar ($5.6B). Clearly there’s a lot of economic diversity across such a large continent. The single biggest takeaway from our export map of Africa is how the continent relies almost entirely on raw materials for its top exports. There isn’t a single country specializing in high-end industries like medicine, with the exception of St. Helena, which is a tiny island nation. Morocco is the only country supplying finished products as its top export (automotives) to the world. The rest of the continent is focused in heavy industries and raw materials like petroleum, gold and copper exports.

The single biggest takeaway from our export map of Africa is how the continent relies almost entirely on raw materials for its top exports. There isn’t a single country specializing in high-end industries like medicine, with the exception of St. Helena, which is a tiny island nation. Morocco is the only country supplying finished products as its top export (automotives) to the world. The rest of the continent is focused in heavy industries and raw materials like petroleum, gold and copper exports. The top exports from countries in Oceania don’t come with any surprises. Island nations specialize primarily in fishing industries and the manufacturing of yachts and cruise ships. Australia’s single biggest export is coal ($57.2B), making it the second largest minerals exporter in the world behind Switzerland ($63.8B).

The top exports from countries in Oceania don’t come with any surprises. Island nations specialize primarily in fishing industries and the manufacturing of yachts and cruise ships. Australia’s single biggest export is coal ($57.2B), making it the second largest minerals exporter in the world behind Switzerland ($63.8B).

The most valuable imports in North America almost couldn’t be more straightforward. Americans and Canadians love to buy foreign cars, while Mexico and Greenland clearly need a lot of oil.

The most valuable imports in North America almost couldn’t be more straightforward. Americans and Canadians love to buy foreign cars, while Mexico and Greenland clearly need a lot of oil. The most valuable imports for European countries are likewise oil and cars. In fact, several contiguous countries stretching from France up to Sweden and back down to Romania have vehicles as their most valuable import. Across Southern Europe, oil remains the most valuable, similar to the countries in Eastern Europe. The only exceptions to the general prevalence of oil and vehicles in European import markets are Switzerland (gold), Bulgaria (copper) and Macedonia (platinum).

The most valuable imports for European countries are likewise oil and cars. In fact, several contiguous countries stretching from France up to Sweden and back down to Romania have vehicles as their most valuable import. Across Southern Europe, oil remains the most valuable, similar to the countries in Eastern Europe. The only exceptions to the general prevalence of oil and vehicles in European import markets are Switzerland (gold), Bulgaria (copper) and Macedonia (platinum). Similar to the situation across Europe, cars and oil dominate Asian import markets. There is one important caveat we should mention about our map. It is very common for global supply chains to touch multiple countries. This means that as things like electronics are assembled, they might pass through multiple places before ultimately landing in the destination market. This could be one reason why Malaysia, Vietnam and the Philippines, for example, have electronics listed as their most valuable imports.

Similar to the situation across Europe, cars and oil dominate Asian import markets. There is one important caveat we should mention about our map. It is very common for global supply chains to touch multiple countries. This means that as things like electronics are assembled, they might pass through multiple places before ultimately landing in the destination market. This could be one reason why Malaysia, Vietnam and the Philippines, for example, have electronics listed as their most valuable imports. Our map of the top imports across Africa contains an obvious insight into these economies. Instead of importing valuable consumer goods like electronics or high-priced manufacturing items like cars, a lot of African countries need to buy food and medicine from the world. Petroleum still figures to be an important category, however Africa is the only continent in the world where things like wheat and meat are the most valuable imports.

Our map of the top imports across Africa contains an obvious insight into these economies. Instead of importing valuable consumer goods like electronics or high-priced manufacturing items like cars, a lot of African countries need to buy food and medicine from the world. Petroleum still figures to be an important category, however Africa is the only continent in the world where things like wheat and meat are the most valuable imports. Our picture of top imports across Oceania echoes many of the themes from our other maps. Petroleum is the single most common category of imports. The Marshall Islands spend more on cruise ships than anything else. New Zealanders import a lot of cars every year, and some remote countries rely on food imports more than anything else

Our picture of top imports across Oceania echoes many of the themes from our other maps. Petroleum is the single most common category of imports. The Marshall Islands spend more on cruise ships than anything else. New Zealanders import a lot of cars every year, and some remote countries rely on food imports more than anything else