Drinking coffee means that you will live longer. So says a host of recent research. Even if the exact cause of increased longevity isn’t caffeine, about 2 out of 3 American adults drink a cup of coffee every day. That means the market for getting a cup o’ joe is absolutely enormous, and we decided to figure out which countries are responsible for supplying most of us with our daily morning ritual.

We found the data for our visualization at the CIA World Factbook. We placed a circle on a world map corresponding to the market size of exports leaving each country in 2017, the latest year for which numbers are available. This lets you easily see which countries (and which continents) lead the world in coffee exports.

We found the data for our visualization at the CIA World Factbook. We placed a circle on a world map corresponding to the market size of exports leaving each country in 2017, the latest year for which numbers are available. This lets you easily see which countries (and which continents) lead the world in coffee exports.

Top 10 Countries Exporting the Most Coffee

1. Brazil: $4.6B

2. Vietnam: $3.5B

3. Germany: $2.64B

4. Colombia: $2.58B

5. Switzerland: $2.2B

6. Italy: $1.6B

7. Indonesia: $1.19B

8. Honduras: $1.16B

9. France: $1.07B

10. Belgium: $.94B

What insights can be gleaned from our visualization? First and most obviously, export statistics don’t only take into consideration where a particular product is initially produced. For example, Germany and Switzerland are both prominently displayed on the visualization, but that’s not because farmers are able to grow massive amounts of coffee beans there. Instead, they import green coffee beans from less developed parts of the world, roast it, and then ship it around the world. Roasting and flavoring coffee beans takes a lot of electricity and water, resources that developing parts of the commonly don’t have in abundance. It therefore makes a lot of sense to locate these activities close to where rich consumers throughout Western Europe live.

Taking a step back and looking only at countries where coffee beans actually grow, there are a few major players with over $2B in exports, namely Brazil ($4.6B), Vietnam ($3.5B) and Colombia ($2.58B). Combined, they account for 32.7% of the entire world’s exports. Any of these countries alone generate more coffee beans than the entire continent of Africa, a testament to how underdeveloped the industry is there. Ethiopia, Africa’s largest coffee exporter ($938M), doesn’t even crack the top ten rankings.

And yet the international coffee market is relatively dispersed among dozens and dozens of different countries. Only two account for more than 10% of the global export market, and 17 different nations contribute between 1-5% each. That means there’s no shortage of options when it comes to getting your daily fix of caffeine.

Data: Table 1.1

We found our data at the

We found our data at the

We made our visualization using data from

We made our visualization using data from We originally found the data for our visualization from

We originally found the data for our visualization from We collected the data for our visualization from the

We collected the data for our visualization from the Think of our new visualization as a spiraling timeline. We gathered CEO-to-worker compensation ratios from the

Think of our new visualization as a spiraling timeline. We gathered CEO-to-worker compensation ratios from the

We found the numbers for our visualization from the

We found the numbers for our visualization from the We created our map by first taking the

We created our map by first taking the We got the data for our visualization through the

We got the data for our visualization through the We found the numbers behind our latest map from

We found the numbers behind our latest map from

We

We Our data come from the

Our data come from the We determined the world’s top 50 tech giants based on market cap using a

We determined the world’s top 50 tech giants based on market cap using a

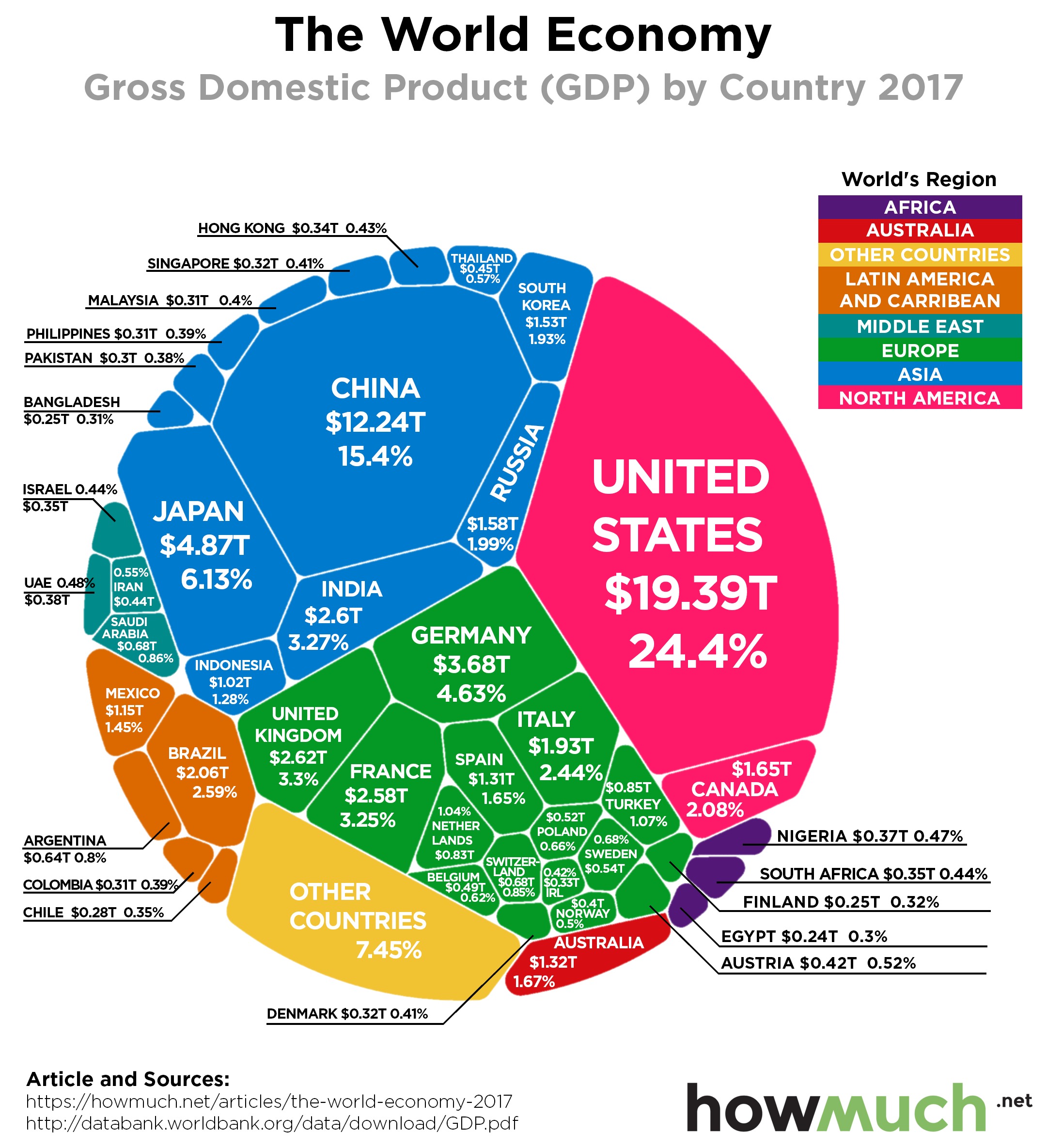

Our visualization neatly slices the latest 2017 GDP numbers from the

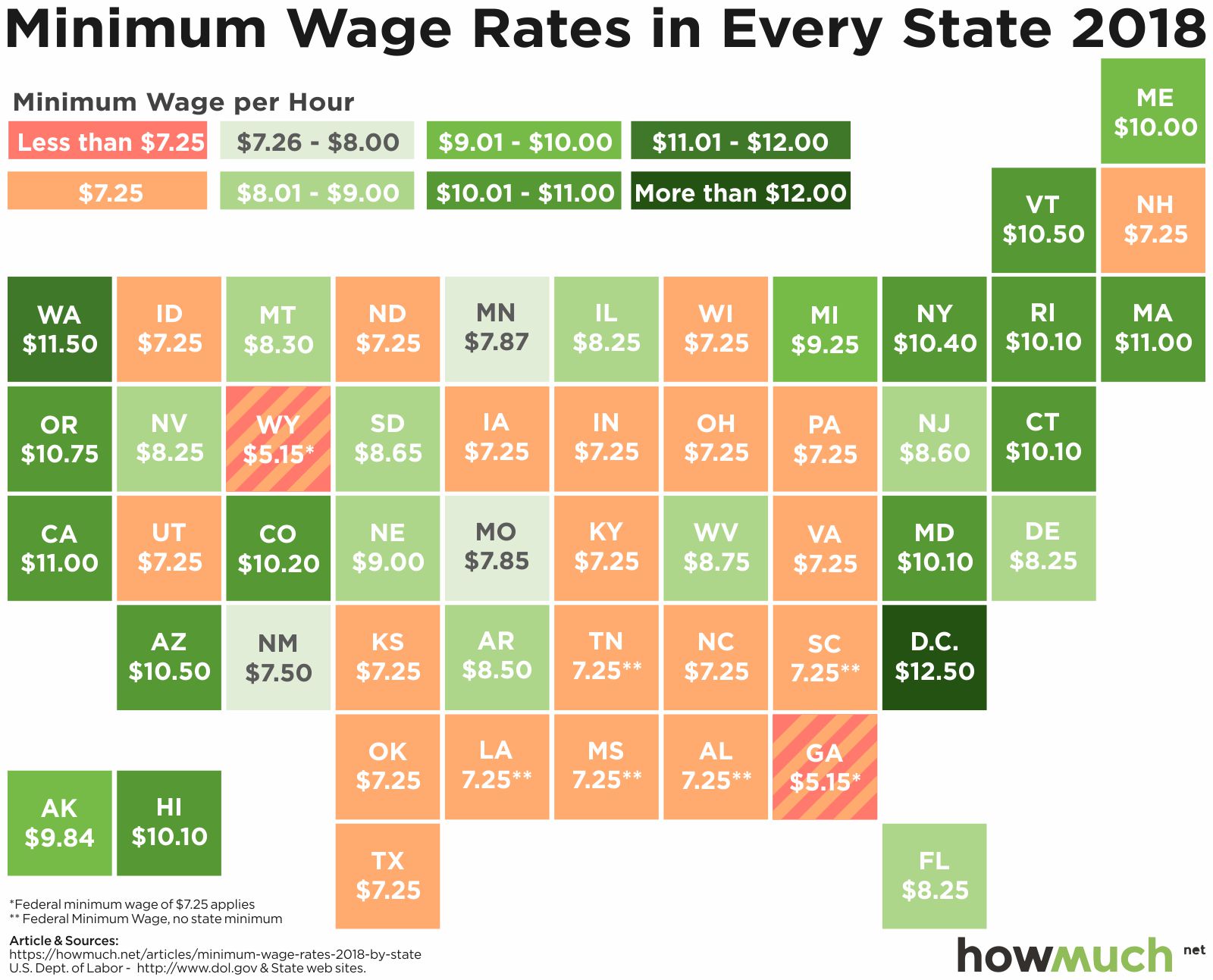

Our visualization neatly slices the latest 2017 GDP numbers from the In the chart above, states are colored based on the value of their minimum wage. The lowest minimum wage states are colored peach, with other states becoming a darker shade of green as the minimum wage increases. The wage laws don’t apply to certain positions, such as wages for tipped workers. The data were collected from the

In the chart above, states are colored based on the value of their minimum wage. The lowest minimum wage states are colored peach, with other states becoming a darker shade of green as the minimum wage increases. The wage laws don’t apply to certain positions, such as wages for tipped workers. The data were collected from the  In the graphic above, every country that imported autos into the United States in 2017 is represented by a circle containing the flag and map of that country. The larger the value of vehicle exports to the U.S., the largest the circle of a country becomes. The data were collected from the

In the graphic above, every country that imported autos into the United States in 2017 is represented by a circle containing the flag and map of that country. The larger the value of vehicle exports to the U.S., the largest the circle of a country becomes. The data were collected from the