Becoming a successful billionaire is the dream of many Americans. But often times people are more impressed by the charitable actions of billionaires, rather than by their success. This may be why Forbes included a new philanthropy score to its latest 400 billionaires list. Take a look at our chart below to see the wealthiest 30 Americans and their philanthropy score.

In the graphic above, the 30 wealthiest Americans are ranked from left to right. Each billionaire is represented by their name, the means by which they made their money, net worth and the new philanthropy score. The larger the billionaire’s net worth, the larger the green circle becomes. Philanthropy scores are measured on a scale of between 1 and 5, with 5 being the most philanthropic. If no charitable donations could be found, a philanthropic score of N.A. is applied. The data were collected from Forbes.

In the graphic above, the 30 wealthiest Americans are ranked from left to right. Each billionaire is represented by their name, the means by which they made their money, net worth and the new philanthropy score. The larger the billionaire’s net worth, the larger the green circle becomes. Philanthropy scores are measured on a scale of between 1 and 5, with 5 being the most philanthropic. If no charitable donations could be found, a philanthropic score of N.A. is applied. The data were collected from Forbes.

Top 10 Wealthiest American's & Philanthropy Score

-

Jeff Bezos: $160 billion; 2

-

Bill Gates: $97 billion; 5

-

Warren Buffet: $88.3 billion; 5

-

Mark Zuckerberg: $61 billion; 5

-

Larry Ellison: $58.4 billion; 4

-

Larry Page: $53.8 billion; 4

-

Charles Koch: $53.5 billion; 4

-

David Koch: $53.5 billion; 4

-

Sergey Brin: $52.4 billion; 4

-

Michael Bloomberg: $51.8 billion; 5

The new Forbes 400 list had an unsurprising change: Jeff Bezos - the founder, chairman and CEO of online retail giant Amazon – has supplanted Microsoft co-founder Bill Gates as the world’s richest man. According to Forbes, Bezos has added $78.5 billion to his net worth in the past year, giving him a total net worth of around $160 billion. Bezos has received a lot of attention in 2018 for his meteoric rise, but his philanthropy score of 2 is far from the highest. In fact, the next three richest billionaires – Bill Gates, Warren Buffet and Mark Zuckerberg – all have a philanthropy score of 5, the highest possible score.

According to Forbes, the way the philanthropy score was derived partially based on a billionaire’s involvement with the Giving Pledge. The movement was created by Bill and Melinda Gates and Warren Buffet, with more than 40 other billionaires joining soon thereafter, in which billionaires promise to give away half or more of their fortunes. Jeff Bezos is not part of the Giving Pledge, which may help to explain is relatively lower philanthropy score.

There appears to be a correlation between the net worth of an individual and how much they give away to charity. The higher a billionaire’s net worth, the more they give away, not just in absolute terms, but in percentage terms as well. The further you go down on the billionaire’s list, the more ‘N/A’ philanthropy scores you see, as well as generally lower philanthropy scores in general. Forbes mentioned that in order to get a philanthropy score of 5, a billionaire had to give away at least $1 billion and/or 20% of their net worth. By that measure, only 29 of America’s 400 richest met that standard. George Soros gave away more than any other at a total of $32 billion, or 79% of his wealth, given to charity.

Jeff Bezos may now be the richest man in the world, but he is far from the most charitable. Billionaire’s are known for their philanthropy, but when it comes to charity, not all billionaires are created equal. If you ever become a billionaire sometime in the future, remember to give away as much as you can to get your philanthropy score to 5!

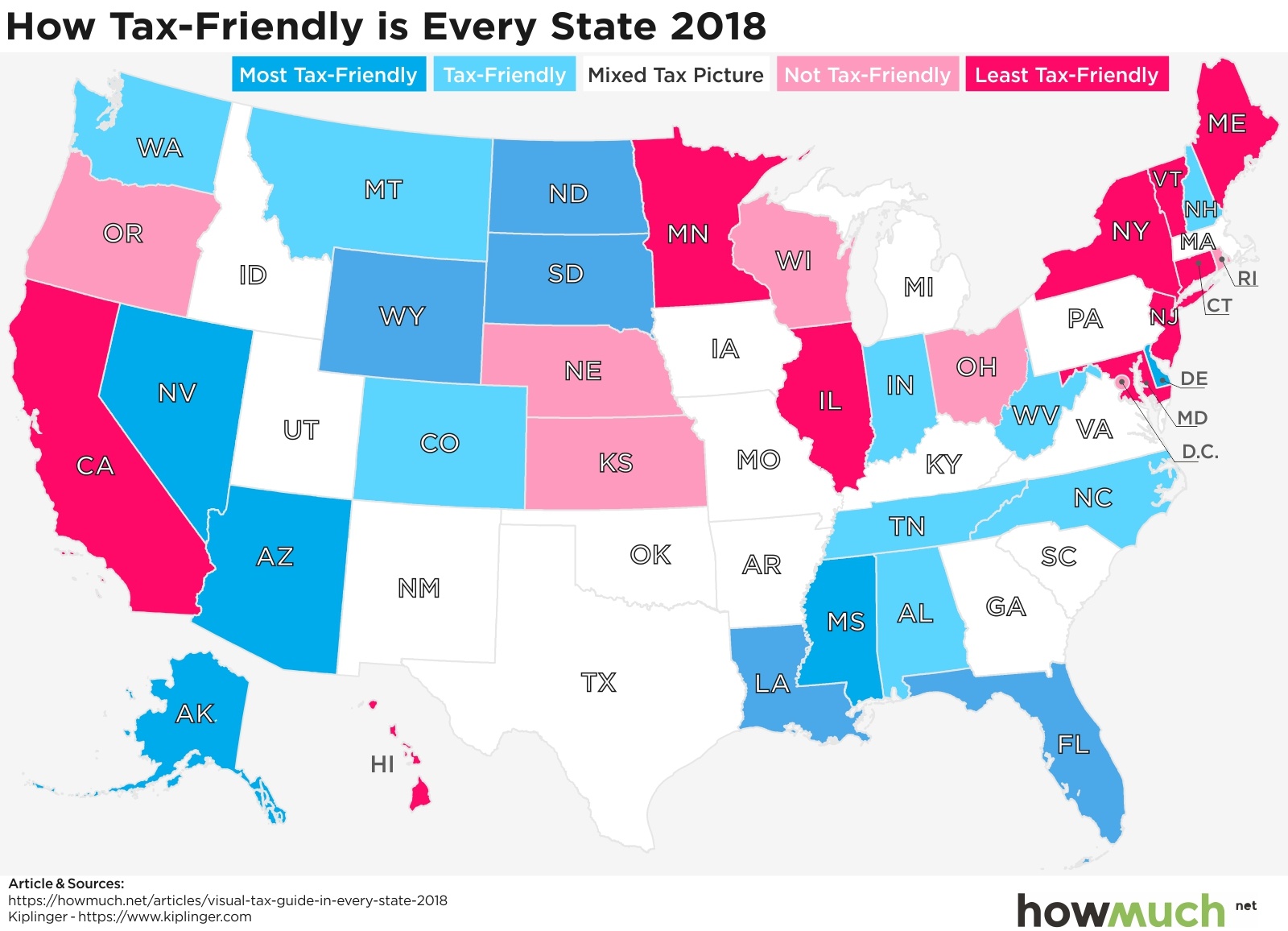

Let’s take a closer look at state income taxes, which vary wildly across the country. According to the

Let’s take a closer look at state income taxes, which vary wildly across the country. According to the Income taxes are only part of the picture. State governments must raise revenue in one way or another, and an obvious method to pad state coffers is by taxing consumption. Only 4 states don’t have any sales tax: Delaware, Montana, New Hampshire and Oregon. Note how all the states without income taxes have some form of sales tax, especially Washington with one of the highest rates in the country at 9.19%. Also consider the group of states in the South, which our first map highlighted as tax friendly, but these same places have some of the highest sales tax rates in the country. This suggests low tax rates on other items (like income, gas and inheritance) is compensated by taxing consumption.

Income taxes are only part of the picture. State governments must raise revenue in one way or another, and an obvious method to pad state coffers is by taxing consumption. Only 4 states don’t have any sales tax: Delaware, Montana, New Hampshire and Oregon. Note how all the states without income taxes have some form of sales tax, especially Washington with one of the highest rates in the country at 9.19%. Also consider the group of states in the South, which our first map highlighted as tax friendly, but these same places have some of the highest sales tax rates in the country. This suggests low tax rates on other items (like income, gas and inheritance) is compensated by taxing consumption. One area of consumption that applies to almost everybody is the gasoline tax, which the

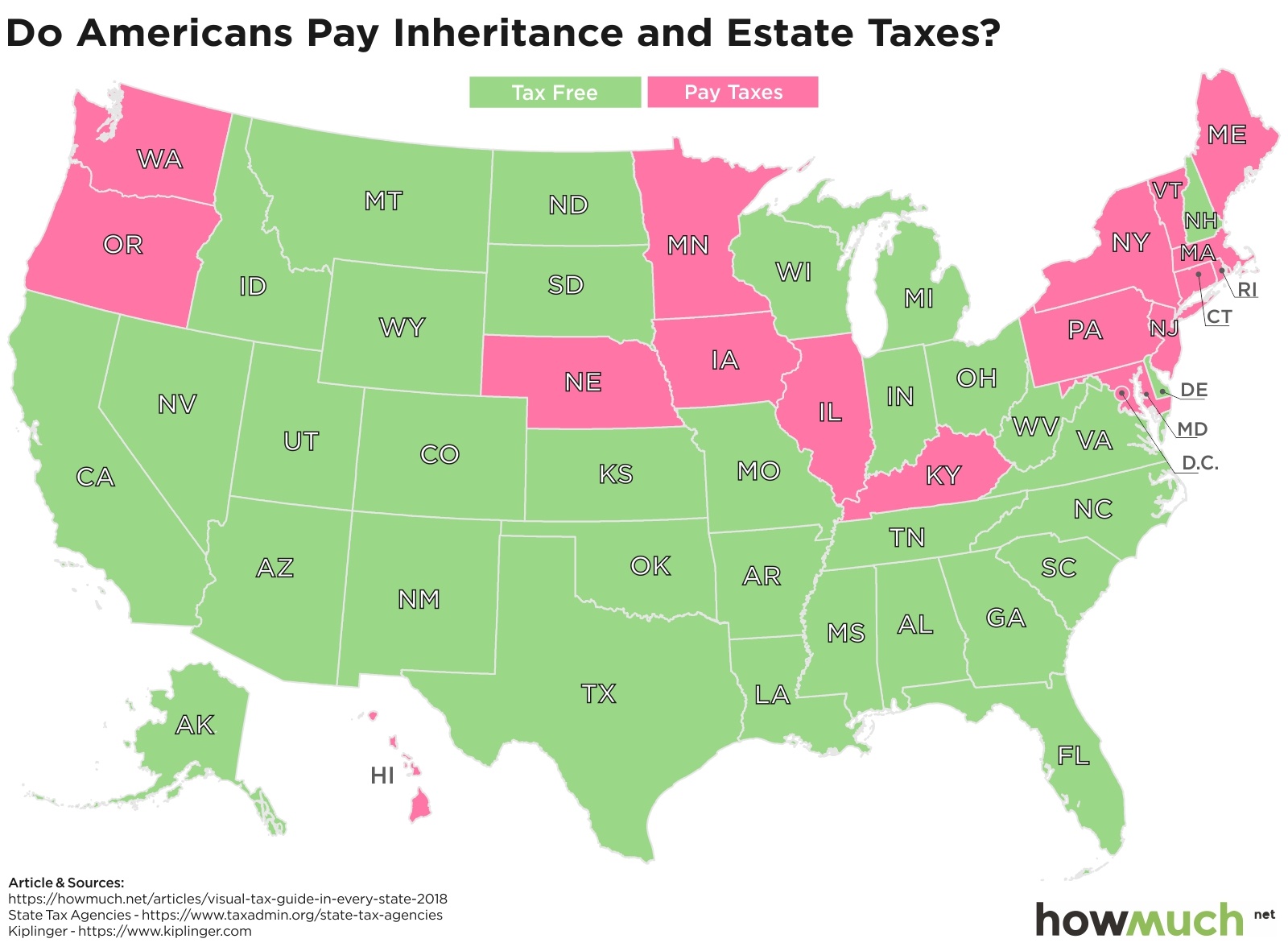

One area of consumption that applies to almost everybody is the gasoline tax, which the Some taxes are easier to avoid than others. If you don’t like paying a lot for your state’s gasoline tax, then purchase a more efficient vehicle. But what if you want to shield your estate from the death tax? Our map indicates the best strategy might be to simply move south or west. No state below Kentucky has an inheritance tax, and Washington and Oregon are the only two out West with some type of “death” tax. Keep in mind that most states only tax estates worth more than an established threshold, often a very high amount. For example, in Illinois an estate must be worth

Some taxes are easier to avoid than others. If you don’t like paying a lot for your state’s gasoline tax, then purchase a more efficient vehicle. But what if you want to shield your estate from the death tax? Our map indicates the best strategy might be to simply move south or west. No state below Kentucky has an inheritance tax, and Washington and Oregon are the only two out West with some type of “death” tax. Keep in mind that most states only tax estates worth more than an established threshold, often a very high amount. For example, in Illinois an estate must be worth

The World Bank provides an in-depth explanation for its methodology, which you can find in Appendix A of the full report

The World Bank provides an in-depth explanation for its methodology, which you can find in Appendix A of the full report It’s clear that the one continent with the most extreme levels of poverty is Africa. There are only five countries on the entire landmass where less than 5% of the population lives in abject poverty, and in fact most places have levels well over 25%. The only group of green countries is clustered to the north along the Mediterranean, notably the ones closest to Europe and furthest from the heart of Africa. The Democratic Republic of Congo (77.1%) and Madagascar (77.6%) are at the epicenter of global extreme poverty. They are the 2 poorest countries on the planet, where it’s far more common to find someone living on less than $2/day than not.

It’s clear that the one continent with the most extreme levels of poverty is Africa. There are only five countries on the entire landmass where less than 5% of the population lives in abject poverty, and in fact most places have levels well over 25%. The only group of green countries is clustered to the north along the Mediterranean, notably the ones closest to Europe and furthest from the heart of Africa. The Democratic Republic of Congo (77.1%) and Madagascar (77.6%) are at the epicenter of global extreme poverty. They are the 2 poorest countries on the planet, where it’s far more common to find someone living on less than $2/day than not. There’s no better continent to illustrate the differences between the global North and South than Asia, but the 2 countries deserving special consideration here are China (0.7%) and India (21.2%). China has pursued an aggressive modernization effort under authoritarianism and one-party rule. By contrast, India is a democratic republic also undergoing a massive transformation. And

There’s no better continent to illustrate the differences between the global North and South than Asia, but the 2 countries deserving special consideration here are China (0.7%) and India (21.2%). China has pursued an aggressive modernization effort under authoritarianism and one-party rule. By contrast, India is a democratic republic also undergoing a massive transformation. And South America also has an interesting story to tell. Keep in mind, the World Bank’s numbers are the latest available, which means 2015 or even 2011 for some countries. We mention this because the

South America also has an interesting story to tell. Keep in mind, the World Bank’s numbers are the latest available, which means 2015 or even 2011 for some countries. We mention this because the Skipping across the Pacific Ocean to Australia, we find a developed English-speaking country in Australia (0.5%) very close to countries in abject poverty like Papua New Guinea (38.0%) and Timor-Leste (30.3%). That being said, Australia generally has far friendlier immigration policies than other developed countries, so much so that one could say it has an

Skipping across the Pacific Ocean to Australia, we find a developed English-speaking country in Australia (0.5%) very close to countries in abject poverty like Papua New Guinea (38.0%) and Timor-Leste (30.3%). That being said, Australia generally has far friendlier immigration policies than other developed countries, so much so that one could say it has an The winners in the global economy today are the same countries that colonized places life Africa and South America years ago. Indeed, the world looks decisively different in Western Europe, where only one country, Romania, has more than 5% of its population living in extreme poverty. Almost every country has fewer than 1% living in such a condition, and many report 0.0%. Social democracies with developed economies and rich in natural resources—there’s no wonder why so many immigrants want to move to the West.

The winners in the global economy today are the same countries that colonized places life Africa and South America years ago. Indeed, the world looks decisively different in Western Europe, where only one country, Romania, has more than 5% of its population living in extreme poverty. Almost every country has fewer than 1% living in such a condition, and many report 0.0%. Social democracies with developed economies and rich in natural resources—there’s no wonder why so many immigrants want to move to the West. And lastly, consider North America, where the rate of extreme poverty declines the further north one travels from Mexico (2.5%) to the United States (1.2%) and Canada (0.5%). There is actually an interesting comparison here, which is to say that the United States is proportionally home to more people subsisting on $1.90/day than China (0.7%). That being said, there are

And lastly, consider North America, where the rate of extreme poverty declines the further north one travels from Mexico (2.5%) to the United States (1.2%) and Canada (0.5%). There is actually an interesting comparison here, which is to say that the United States is proportionally home to more people subsisting on $1.90/day than China (0.7%). That being said, there are We analyzed changes in employment figures between 2013 and 2018 from the 381 metropolitan areas defined by the

We analyzed changes in employment figures between 2013 and 2018 from the 381 metropolitan areas defined by the  The

The

Looking at the average net worth across the entire world indicates the enormous disparity between the developed world and everyone else. At one extreme, there are countries with net worth numbers over $500,000, and at the other extreme, there are places where people have less than $500 to their names. There is a smattering or light orange countries in between, but the worldwide map demonstrates an astonishing level of inequality between the have’s and the have-not’s.

Looking at the average net worth across the entire world indicates the enormous disparity between the developed world and everyone else. At one extreme, there are countries with net worth numbers over $500,000, and at the other extreme, there are places where people have less than $500 to their names. There is a smattering or light orange countries in between, but the worldwide map demonstrates an astonishing level of inequality between the have’s and the have-not’s. The story in North America is one of stark inequality. Northern countries like Greenland, Canada and the United States boast extremely high average figures. It’s no surprise that Americans are by far the wealthiest with $404K, but take a look at Mexico ($20.6K) and even the Bahamas ($47.8K). This means that the US is 10 times richer than the Bahamas and an eye-popping 20 times wealthier than Mexico.

The story in North America is one of stark inequality. Northern countries like Greenland, Canada and the United States boast extremely high average figures. It’s no surprise that Americans are by far the wealthiest with $404K, but take a look at Mexico ($20.6K) and even the Bahamas ($47.8K). This means that the US is 10 times richer than the Bahamas and an eye-popping 20 times wealthier than Mexico. South America on the other hand reports some rather depressing numbers. Chile has the highest average in the region at $62.2K, followed by the Cayman Islands and French Guiana (both at $55.3K). However, the average across all of Latin America is a tiny $24.4K. Haiti, one of the poorest places in the entire world, only has $2.5K per adult. That’s why immigration usually happens from the South to the North.

South America on the other hand reports some rather depressing numbers. Chile has the highest average in the region at $62.2K, followed by the Cayman Islands and French Guiana (both at $55.3K). However, the average across all of Latin America is a tiny $24.4K. Haiti, one of the poorest places in the entire world, only has $2.5K per adult. That’s why immigration usually happens from the South to the North. Europe is the most fascinating continent in our series of maps for a few reasons. There’s an obvious contrast between East and West running right down the middle of the region. Germany ($214.9K), the Czech Republic ($61.5K) and Austria ($231.4K) fall into the upper (green) tiers on our map, but right next door, countries like Poland ($31.8K), Slovakia ($34.8) and Hungary ($37.6K) remain far behind. And the further east you travel, the poorer the country. Ukraine ($1.6K) and Belarus ($1.5K) are both worse off than even the poorest countries in the entire Western Hemisphere. There’s another trend worth pointing out hiding behind our color-coded map, and that’s the difference in wealth between northern and southern European countries. In general, the further north and west, the wealthier the country.

Europe is the most fascinating continent in our series of maps for a few reasons. There’s an obvious contrast between East and West running right down the middle of the region. Germany ($214.9K), the Czech Republic ($61.5K) and Austria ($231.4K) fall into the upper (green) tiers on our map, but right next door, countries like Poland ($31.8K), Slovakia ($34.8) and Hungary ($37.6K) remain far behind. And the further east you travel, the poorer the country. Ukraine ($1.6K) and Belarus ($1.5K) are both worse off than even the poorest countries in the entire Western Hemisphere. There’s another trend worth pointing out hiding behind our color-coded map, and that’s the difference in wealth between northern and southern European countries. In general, the further north and west, the wealthier the country. The situation in Africa is simply depressing. Our map highlights the soul-crushing extreme levels of poverty found in places like Burundi ($321), Ethiopia ($167) and Malawi ($141). To put these numbers in perspective, the United States is well over 1,000 times wealthier on an average individual basis. There is one pocket of relative prosperity worth pointing out in Libya ($61.7K), but not even this is good enough to break the top 50 wealthiest countries in the world.

The situation in Africa is simply depressing. Our map highlights the soul-crushing extreme levels of poverty found in places like Burundi ($321), Ethiopia ($167) and Malawi ($141). To put these numbers in perspective, the United States is well over 1,000 times wealthier on an average individual basis. There is one pocket of relative prosperity worth pointing out in Libya ($61.7K), but not even this is good enough to break the top 50 wealthiest countries in the world. Our snapshot of wealth in Asia similarly provides an interesting view of the global economy. Take note of the line of relative poverty stretching from Syria in the west all the way to Vietnam on the Pacific Ocean. Now look at all the green countries, like Japan ($227.2K), South Korea ($171.7K) and Taiwan ($212.4K). Together with Singapore, Hong Kong, the UAE and Israel, these countries are all firmly aligned with American foreign policy and Western institutions. The wealth of these nations stands in contrast to adversaries like Russia ($20K) and China ($47.8K).

Our snapshot of wealth in Asia similarly provides an interesting view of the global economy. Take note of the line of relative poverty stretching from Syria in the west all the way to Vietnam on the Pacific Ocean. Now look at all the green countries, like Japan ($227.2K), South Korea ($171.7K) and Taiwan ($212.4K). Together with Singapore, Hong Kong, the UAE and Israel, these countries are all firmly aligned with American foreign policy and Western institutions. The wealth of these nations stands in contrast to adversaries like Russia ($20K) and China ($47.8K). And finally, the picture of wealth in Oceania provides a nice bookend to our worldwide tour. Australia ($411.1K) and New Zealand ($289.8K) both stand out at the top of the pack, but some islands like French Polynesia, Palau and New Caledonia aren’t so far behind either ($203.9K each). Part of the explanation why is no doubt the robust and longstanding high-end tourism industries in these countries, which provide relatively strong individual wealth numbers.

And finally, the picture of wealth in Oceania provides a nice bookend to our worldwide tour. Australia ($411.1K) and New Zealand ($289.8K) both stand out at the top of the pack, but some islands like French Polynesia, Palau and New Caledonia aren’t so far behind either ($203.9K each). Part of the explanation why is no doubt the robust and longstanding high-end tourism industries in these countries, which provide relatively strong individual wealth numbers.

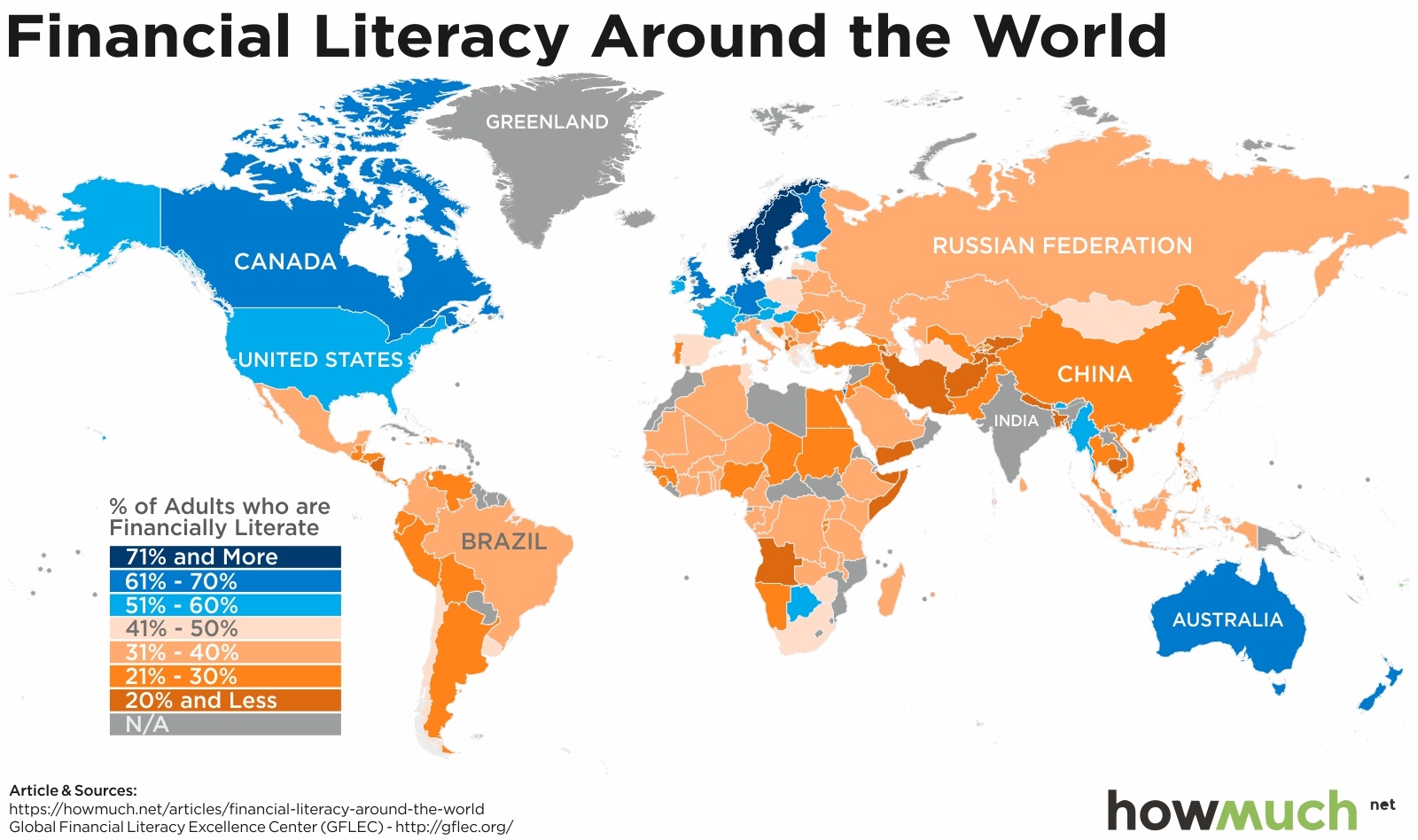

The obvious conclusion to draw from our map of North America is that financial literacy improves the further north one travels. Mexico’s 32% compares favorably to countries further south, but it stands in stark contrast to the US (57%) and Canada (68%). Researchers weren’t able to collect data from Greenland.

The obvious conclusion to draw from our map of North America is that financial literacy improves the further north one travels. Mexico’s 32% compares favorably to countries further south, but it stands in stark contrast to the US (57%) and Canada (68%). Researchers weren’t able to collect data from Greenland. In a word, financial literacy rates in South America are depressing. Uruguay and Chile post the best rates at 45% and 41%, respectively, but most places fall between 21%-30%. There are no doubt lots of historical explanations for this disparity, but Nicaragua (20%) stands out as particularly troubling. It has the lowest score in all of Central and South America excluding the Caribbean, and it’s indicative of the desperate situation in that country.

In a word, financial literacy rates in South America are depressing. Uruguay and Chile post the best rates at 45% and 41%, respectively, but most places fall between 21%-30%. There are no doubt lots of historical explanations for this disparity, but Nicaragua (20%) stands out as particularly troubling. It has the lowest score in all of Central and South America excluding the Caribbean, and it’s indicative of the desperate situation in that country. But there’s no other place in the world with such wide-ranging differences in financial literacy as Europe. The continent is anchored by a group of high scoring countries in Scandinavia, most notably Norway and Sweden (both scoring 71%). In fact, northwestern European countries appear to perform the best on the Financial Literacy Survey, and the further south one looks, the worse the situation. Portugal manages a paulty 26%, the worst in all of Western Europe. The Eastern Bloc, meanwhile, has some obvious and staggering problems, with no country east or south of Hungary scoring over 50%.

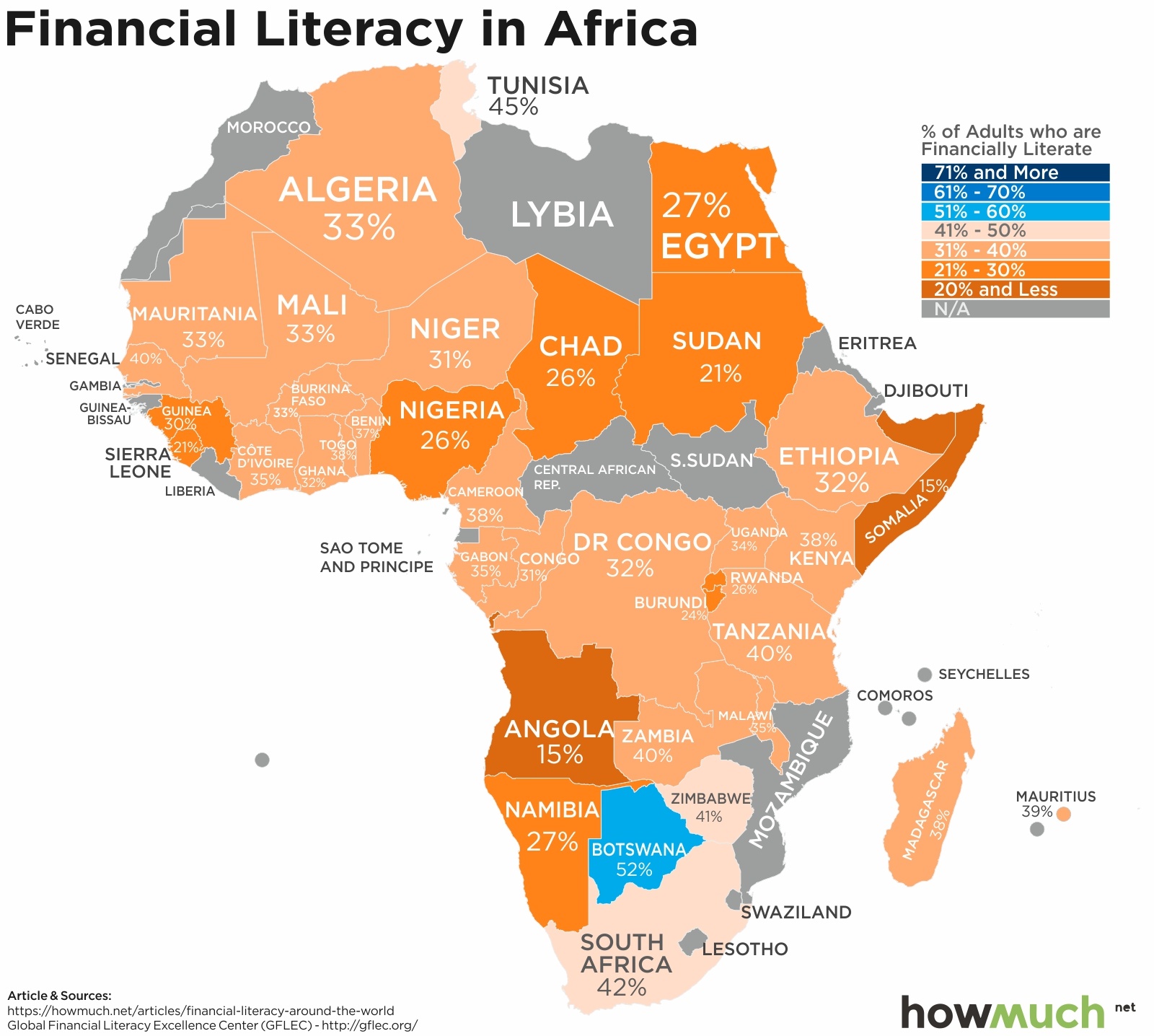

But there’s no other place in the world with such wide-ranging differences in financial literacy as Europe. The continent is anchored by a group of high scoring countries in Scandinavia, most notably Norway and Sweden (both scoring 71%). In fact, northwestern European countries appear to perform the best on the Financial Literacy Survey, and the further south one looks, the worse the situation. Portugal manages a paulty 26%, the worst in all of Western Europe. The Eastern Bloc, meanwhile, has some obvious and staggering problems, with no country east or south of Hungary scoring over 50%. Like on so many other measures of economic progress and development, Africa scores the worst of all the continents. Only one country, Botswana, breaks the 50% barrier, with more places falling in the 31%-40% range. The worst country for financial literacy on the entire continent is Somalia, at 15%. The situation in Western Africa isn’t much better, where Sierra Leone is at 21%.

Like on so many other measures of economic progress and development, Africa scores the worst of all the continents. Only one country, Botswana, breaks the 50% barrier, with more places falling in the 31%-40% range. The worst country for financial literacy on the entire continent is Somalia, at 15%. The situation in Western Africa isn’t much better, where Sierra Leone is at 21%. The situations in Asia and the Middle East are comparable to Africa. Yemen (13%) and Afghanistan (14%) are at the rock bottom of the worldwide rankings, but they aren’t the only places in the teens. From Kyrgyzstan (19%) to Nepal (18%), Bangladesh (19%) and Cambodia (18%), there are several countries with horrible results. China scored a surprising 28% given it’s the

The situations in Asia and the Middle East are comparable to Africa. Yemen (13%) and Afghanistan (14%) are at the rock bottom of the worldwide rankings, but they aren’t the only places in the teens. From Kyrgyzstan (19%) to Nepal (18%), Bangladesh (19%) and Cambodia (18%), there are several countries with horrible results. China scored a surprising 28% given it’s the  And finally, there’s really no surprise in Oceania. Australia (64%) beats out New Zealand (61%) for the top spot, but otherwise the Financial Literacy Survey wasn’t able to collect robust data from any other country in the region.

And finally, there’s really no surprise in Oceania. Australia (64%) beats out New Zealand (61%) for the top spot, but otherwise the Financial Literacy Survey wasn’t able to collect robust data from any other country in the region. The data behind our map come from

The data behind our map come from Every bubble on our map represents a billionaire, and the size corresponds to the fortunes for every billionaire living in that country. And the size of each country represents the grand total wealth of every billionaire living there. And finally, we color-coded each region, giving you a quick visual snapshot of the world’s most elite individuals.

Every bubble on our map represents a billionaire, and the size corresponds to the fortunes for every billionaire living in that country. And the size of each country represents the grand total wealth of every billionaire living there. And finally, we color-coded each region, giving you a quick visual snapshot of the world’s most elite individuals. Researchers at

Researchers at  The cost of basic health insurance in the U.S. is indeed extremely expensive. Keep in mind these are all monthly figures, meaning some people are spending well over $6,000 just on insurance premiums. But here’s the kicker. State governments play a large role in subsidizing the markets (or not), leading to wide-ranging price disparities between comparable states in the same region. Consider for example Wyoming ($860), by far the most expensive state in the West. Moving directly south to Colorado and purchasing the same type of policy would save you $5,364 each year. Rhode Island takes first place as the most affordable state at only $287, but most states fall into the $400-$500 range.

The cost of basic health insurance in the U.S. is indeed extremely expensive. Keep in mind these are all monthly figures, meaning some people are spending well over $6,000 just on insurance premiums. But here’s the kicker. State governments play a large role in subsidizing the markets (or not), leading to wide-ranging price disparities between comparable states in the same region. Consider for example Wyoming ($860), by far the most expensive state in the West. Moving directly south to Colorado and purchasing the same type of policy would save you $5,364 each year. Rhode Island takes first place as the most affordable state at only $287, but most states fall into the $400-$500 range. Prices for gold plans appear similarly scattered and geographically dependent. Some states have significantly higher costs compared to their silver plans, like Tennessee ($910), the most expensive in the country. And yet Rhode Island remains one of the cheapest marketplaces at only $300, an increase of just $13 from silver.

Prices for gold plans appear similarly scattered and geographically dependent. Some states have significantly higher costs compared to their silver plans, like Tennessee ($910), the most expensive in the country. And yet Rhode Island remains one of the cheapest marketplaces at only $300, an increase of just $13 from silver. A new report from

A new report from First, a couple caveats. Companies had to publicly disclose their expenditures to be included in the ranking. PwC excluded any subsidiaries with financials included in a parent company. For example, Google’s expenditures roll up to its parent company, Alphabet. Taken altogether, the rankings comprise an astonishing 40% of all the world’s R&D spending for 2018, which includes government R&D.

First, a couple caveats. Companies had to publicly disclose their expenditures to be included in the ranking. PwC excluded any subsidiaries with financials included in a parent company. For example, Google’s expenditures roll up to its parent company, Alphabet. Taken altogether, the rankings comprise an astonishing 40% of all the world’s R&D spending for 2018, which includes government R&D. Our visualization provides a useful way to quickly see a snapshot of the housing market before-and-after the Great Recession. The first image from 2007 shows median home values in a heat map. The second image displays prices as of 2017, plus the percentage change in value from 10 years prior. Housing prices declined almost everywhere across the country in 2008 and 2009. Our GIF therefore highlights the places that have seen prices surge in recent years as well as the states that are still recovering from the crash.

Our visualization provides a useful way to quickly see a snapshot of the housing market before-and-after the Great Recession. The first image from 2007 shows median home values in a heat map. The second image displays prices as of 2017, plus the percentage change in value from 10 years prior. Housing prices declined almost everywhere across the country in 2008 and 2009. Our GIF therefore highlights the places that have seen prices surge in recent years as well as the states that are still recovering from the crash. Before the housing bubble burst, the most affordable housing market was sandwiched in the middle of the country between the expensive West and East Coasts. Stretching from North Dakota ($106,800) down to Texas ($120,900), housing prices were relatively cheap. California was the most expensive state on the mainland where the typical house cost an eye-popping $532,300. Another cluster of pricey states can be found in the Northeast around New York. The Upper Midwest around the Great Lakes region was somewhere between these two extremes.

Before the housing bubble burst, the most affordable housing market was sandwiched in the middle of the country between the expensive West and East Coasts. Stretching from North Dakota ($106,800) down to Texas ($120,900), housing prices were relatively cheap. California was the most expensive state on the mainland where the typical house cost an eye-popping $532,300. Another cluster of pricey states can be found in the Northeast around New York. The Upper Midwest around the Great Lakes region was somewhere between these two extremes. In total, median house prices are now higher in 41 states plus Washington, DC than they were in 2007. But a closer look at the map reveals how underwhelming housing prices are. 22 states have seen values climb by 20% or less over the course of 10 years. Granted, prices have not only recovered but surged to double-digit increases in a few locations. North Dakota (+82.3%), Colorado (+49.2%) and Texas (+42.4%) have posted massive gains. The boom in domestic

In total, median house prices are now higher in 41 states plus Washington, DC than they were in 2007. But a closer look at the map reveals how underwhelming housing prices are. 22 states have seen values climb by 20% or less over the course of 10 years. Granted, prices have not only recovered but surged to double-digit increases in a few locations. North Dakota (+82.3%), Colorado (+49.2%) and Texas (+42.4%) have posted massive gains. The boom in domestic Our visualization paints a detailed picture of what’s really going on underneath the surface of alarming headlines about debt. There are different categories of personal debt, like mortgages, student loans, and home equity loans. Some of these are healthy for economic growth. Having a mortgage is good if it lets you build equity. Student loans represent an investment in yourself and usually bring about higher future earning potential. Car loans are likewise necessary because most people can’t afford to buy a vehicle outright.

Our visualization paints a detailed picture of what’s really going on underneath the surface of alarming headlines about debt. There are different categories of personal debt, like mortgages, student loans, and home equity loans. Some of these are healthy for economic growth. Having a mortgage is good if it lets you build equity. Student loans represent an investment in yourself and usually bring about higher future earning potential. Car loans are likewise necessary because most people can’t afford to buy a vehicle outright.