The American economy is finally humming along at a nice clip, and most people are optimistic about the future. Some people are just not starting to see real wage growth, but not everyone. With so much disparity in economic outcomes, it got us thinking about the best jobs in the country.

We gathered information about the best jobs from U.S. News, including the average total compensation for each profession and the projected growth rate over the next decade. U.S News explored a variety of different factors as well, like the stress level and work-life balance associated with each line of work. We wanted to make things simpler. Each figure on our viz represents a profession, the size of which corresponds to the compensation level—the bigger the figure, the more money one can expect to earn. We then color-coded each figure based on future job prospects. Blue figures represent professions with under 10% in total growth, but dark green represents those professions with high growth potential, over 20%. We also arranged the figures in a pyramid, making the winning professions even more obvious. Our viz quickly reveals the best bets for finding a highly paid job in the future.

We gathered information about the best jobs from U.S. News, including the average total compensation for each profession and the projected growth rate over the next decade. U.S News explored a variety of different factors as well, like the stress level and work-life balance associated with each line of work. We wanted to make things simpler. Each figure on our viz represents a profession, the size of which corresponds to the compensation level—the bigger the figure, the more money one can expect to earn. We then color-coded each figure based on future job prospects. Blue figures represent professions with under 10% in total growth, but dark green represents those professions with high growth potential, over 20%. We also arranged the figures in a pyramid, making the winning professions even more obvious. Our viz quickly reveals the best bets for finding a highly paid job in the future.

First off, the majority of the positions on the top half of the pyramid are from the medical profession. Anesthesiologists have the best prospects in terms of overall compensation, netting on average $269,600 each year with a projected growth rate of 17.8% in the available jobs. In fact, every job in the top three levels of the pyramid involve medical school of one kind or another, and they are universally expected to see strong job creation of higher than 10%. In short, going to medical school is still a solid path to earn a good living.

Things get more crowded further down the pyramid. The actuarial sciences are expected to see the strongest overall increase in demand, with 22.5% job growth in the coming years. That suggests actuaries are in for a pay raise as demand for their services outstrips the supply of labor. That being said, actuaries make on average $100,610 per year, not half as much as an anesthesiologist. $100k is nothing to sneeze at, but it’s not the type of work that quickly leads to riches. Political scientists are projected to see the slowest increase in demand, growing only 2.1% in total over the next ten years. Perhaps part of the reason is that political observers have been unable to foresee many of the major political events over the past few years, including President Trump’s election.

Top 10 Highest Paying Jobs with the Most Growth

1. Anesthesiologist: $269,600 and 17.8%

2. Surgeon: $252,910 and 16.8%

3. Obstetrician and gynecologist: $234,310 and 17.9%

4. Oral and maxillofacial surgeon: $232,870 and 17.2%

5. Orthodontist: $228,780 and 17.3%

6. Physician: $201,840 and 14.9%

7. Psychiatrist: $194,740 and 13.1%

8. Pediatrician: $168,990 and 17.8%

9. Nurse anesthetist: $160,270 and 16%

10. Dentist: $159,770 and 17.2%

There are two things to keep in mind about all this data. First, high overall job growth doesn’t matter that much if the profession is small to begin with. For instance, oral and maxillofacial surgeons pull in $232,870 each year, and the profession is expected to grow 17.2% in a decade. But that’s only 1,200 total jobs. Good luck trying to get one! Second, there’s no telling how technology is going to disrupt various industries, including medicine. Do doctors really need so much training when big data can recommend tailored treatment plans specific to each patient’s individual situation? Innovative technologies might render all these projections moot. But that’s the best we can do for now, and for many people, the promise of $250K per year with strong job prospects is more than enough to make medical school an attractive option.

Data: Table 1.1

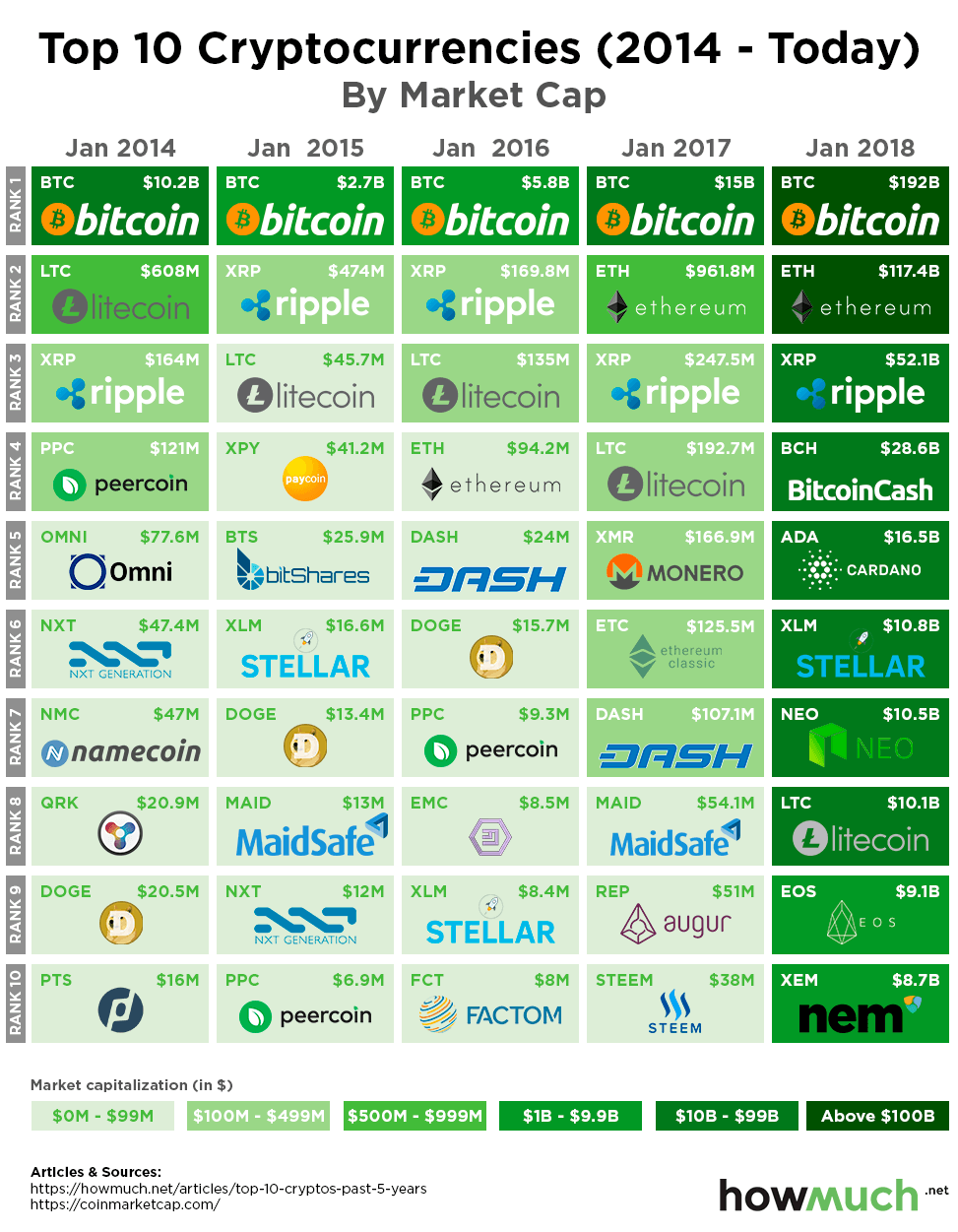

In order to showcase the growth in the overall cryptocurrency, we chose to create a visual showing how the top ten cryptocurrencies by market cap have changed over the past five years. Using January as the benchmark, we found the top ten cryptocurrencies by market cap between the years of 2014 and 2018 from

In order to showcase the growth in the overall cryptocurrency, we chose to create a visual showing how the top ten cryptocurrencies by market cap have changed over the past five years. Using January as the benchmark, we found the top ten cryptocurrencies by market cap between the years of 2014 and 2018 from  We got the data directly from the Medicaid and CHIP Payment Access Commission (

We got the data directly from the Medicaid and CHIP Payment Access Commission ( We got our numbers from the good folks at

We got our numbers from the good folks at MONEY incorporates more than 170,000 data points into its ranking, such low crime rates, the quality of education systems, and public amenities. In short, they conduct a

MONEY incorporates more than 170,000 data points into its ranking, such low crime rates, the quality of education systems, and public amenities. In short, they conduct a We used salary figures from

We used salary figures from We gathered our numbers from

We gathered our numbers from In order to compare the most recent Bitcoin crash to other past panics, we decided to create a visual that clearly shows twelve other times that the top cryptocurrency has sold off. Each box represents a specific time period in which the price of Bitcoin came under extreme selling pressure. Using the

In order to compare the most recent Bitcoin crash to other past panics, we decided to create a visual that clearly shows twelve other times that the top cryptocurrency has sold off. Each box represents a specific time period in which the price of Bitcoin came under extreme selling pressure. Using the  Our map was inspired by the

Our map was inspired by the

In the map above, states are split into four categories based on average monthly premiums per person. States colored red have an average monthly premium of between $651 and $780, states colored pink are between $451 and $550, states colored light green are between $451 and $550 and states colored dark green are between $411 and $450. The data were collected from

In the map above, states are split into four categories based on average monthly premiums per person. States colored red have an average monthly premium of between $651 and $780, states colored pink are between $451 and $550, states colored light green are between $451 and $550 and states colored dark green are between $411 and $450. The data were collected from  In this map, states are split into four categories based on the average annual deductible with a silver plan. States colored dark purple have an average annual deductible of between $5,000 and $6,913, states colored light purple are between $4,000 and $4,999, states colored teal are between $3,000 and $3,999 and states colored dark teal are between $1,733 and $2,999. The data were collected from Stride Health. The figures were calculated based on the average of four popular silver plan deductibles from each state for single males, age 40 years old, non-smokers and annual income of $51,640 (the median income for males of that age). The data were collected from

In this map, states are split into four categories based on the average annual deductible with a silver plan. States colored dark purple have an average annual deductible of between $5,000 and $6,913, states colored light purple are between $4,000 and $4,999, states colored teal are between $3,000 and $3,999 and states colored dark teal are between $1,733 and $2,999. The data were collected from Stride Health. The figures were calculated based on the average of four popular silver plan deductibles from each state for single males, age 40 years old, non-smokers and annual income of $51,640 (the median income for males of that age). The data were collected from  We adopted a list of the largest banks in each state from

We adopted a list of the largest banks in each state from Inside of every state on the map there are the name and logo of the gas station chain that offers the lowest gas prices in that state. There are three tiers of gas prices: states that are dark green have gas chains that offer between $2.50 and $2.99 per gallon of gas, states that are just green prices between $2.00 and $2.49 per gallon and states that are light green offer prices between $1.50 and $1.99 per gallon. The data were collected from

Inside of every state on the map there are the name and logo of the gas station chain that offers the lowest gas prices in that state. There are three tiers of gas prices: states that are dark green have gas chains that offer between $2.50 and $2.99 per gallon of gas, states that are just green prices between $2.00 and $2.49 per gallon and states that are light green offer prices between $1.50 and $1.99 per gallon. The data were collected from

We retrieved the data relating to GDP, unemployment, and median income from the online financial magazine

We retrieved the data relating to GDP, unemployment, and median income from the online financial magazine

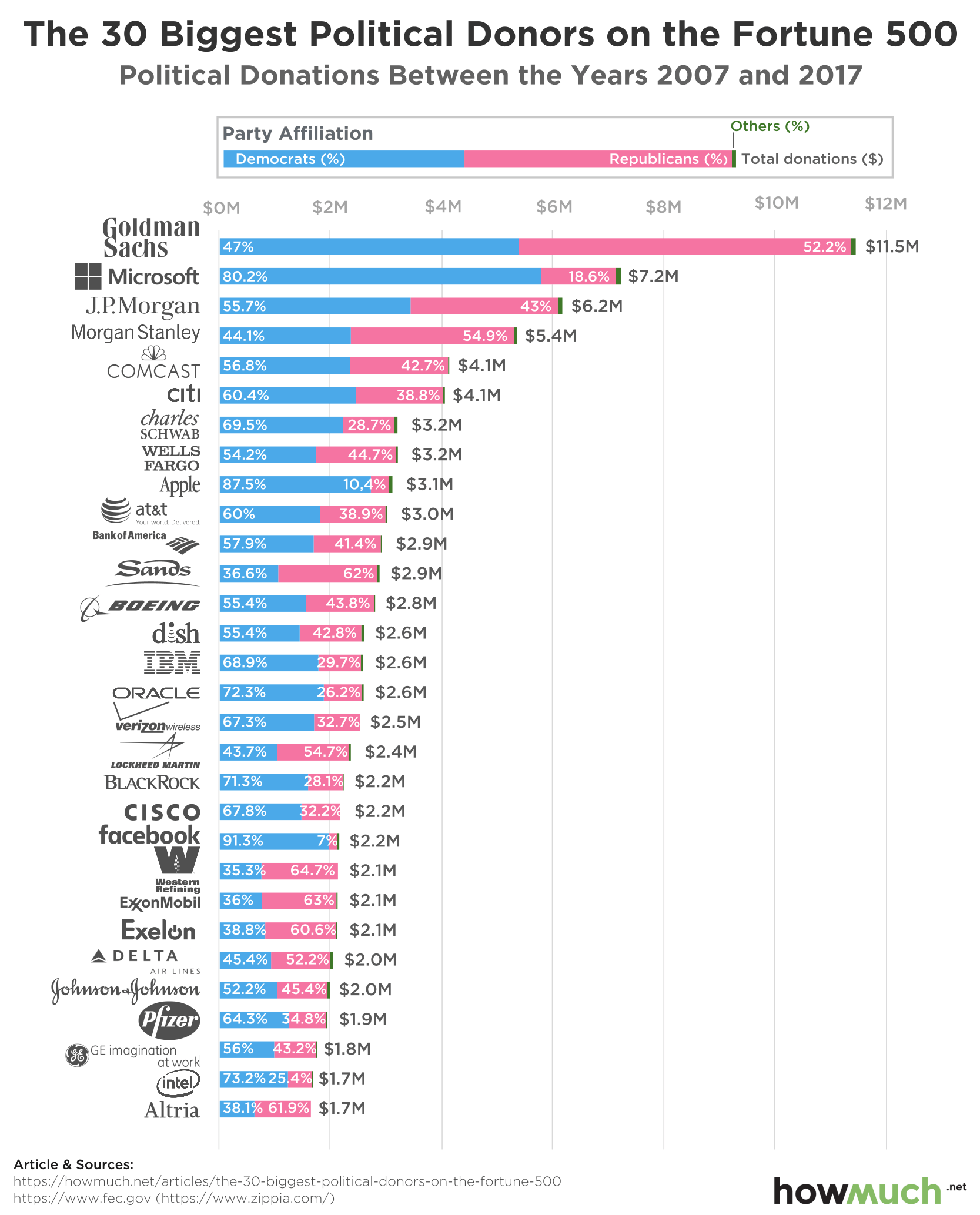

The data included in our map is based on company filings as well as estimates of private company figures from

The data included in our map is based on company filings as well as estimates of private company figures from