The U.S. economy is massive, and no other country even comes close to challenging its supremacy on the global stage. Forget the rhetoric about America in decline. As long as the U.S. can get a grip on its addiction to debt, the economy is poised to dominate the rest of the century. Here’s why.

- The U.S. economy remains the largest and most important in the world. The American dollar is still the top reserve currency, making up 61.82% of the world’s reserves.

- With a total market capitalization of $30.44T, the U.S. stock market is many times more valuable than that of any other country.

- Your individual experience of the American economy depends on where you live. Some states like California have enormous and dynamic economies, but others like Arkansas and Mississippi are lagging behind.

- There are significant problems looming on the horizon. The U.S. national debt is now over $22T, and personal debt tops $70K in several states.

- The U.S. government collects $1.03T in taxes every year, but that’s nowhere near enough money to cover all of the government’s expenditures.

1. America Controls the World’s Largest Reserve Currency![]()

A primary advantage the U.S. economy has over the rest of the world is that other countries hold the U.S. dollar as their reserve currency. In fact, there are $6.74T worth of USD in reserves, or 61.82% of the entire world’s total, according to our breakdown of the world’s top reserve currencies in 2019. The euro doesn’t even come close at $2.21 T or 20.24%.

2. The U.S. Has by Far the Largest Stock Market in the World

And not only does the U.S. enjoy privileged status as the issuer of the biggest reserve currency, but the American stock market is by far the largest, topping $30.44T in value. According to our visualization of all the world’s stock market capitalization, that’s over 44% of the entire world’s market value. To put that in perspective, China is in second place with a total market cap of $6.32T. And to top it off, the U.S. stock markets just hit another record high.

3. The Economies of Individual U.S. States are Larger Than Lots of Countries

What’s the best way to understand how big the U.S. economy is? By comparing U.S. states to entire countries by GDP. This approach reveals just how large and wealthy the American economy is. California ($2.9T) boasts roughly the same GDP as Great Britain ($2.81T). Texas ($1.78T) is equivalent in terms of GDP to Canada ($1.73T). New York ($1.7T) produces as much GDP as all of South Korea ($1.66T).

4. Economic Health Depends Entirely on Where You Live

But not every state’s economy is created equal. Our ranking of relative economic health breaks down several factors, including average weekly wages, wage growth, unemployment rates, job growth, GDP per capita and overall GDP growth. It turns out the Western states lead in terms of economic growth, while the South lags the rest of the country.

But not every state’s economy is created equal. Our ranking of relative economic health breaks down several factors, including average weekly wages, wage growth, unemployment rates, job growth, GDP per capita and overall GDP growth. It turns out the Western states lead in terms of economic growth, while the South lags the rest of the country.

5. The U.S. Trade Deficit With China Keeps Getting Bigger![]()

But there are some problems looming on the horizon for the U.S. economy. One example is the large trade deficit with China, which has grown substantially over the last ten years, even under President Trump. In fact, exports declined in 2018 to $120B from $130B in 2017, while imports grew significantly from $505B to $540B. The trade deficit continues to get larger and larger no matter Trump’s tariffs.

6. The National Debt is Exploding

The trade deficit is on an upward trajectory, but the U.S. national debt is simply exploding. Large numbers can be scary, and they can make people pay attention to a growing problem. According to our visualization of the U.S. national debt from 1934 to today, over the last decade, the U.S. added a trillion bucks to the national debt every single year. It seems like nobody cares about the mounting national debt anymore, and that could present a problem in the future.

The trade deficit is on an upward trajectory, but the U.S. national debt is simply exploding. Large numbers can be scary, and they can make people pay attention to a growing problem. According to our visualization of the U.S. national debt from 1934 to today, over the last decade, the U.S. added a trillion bucks to the national debt every single year. It seems like nobody cares about the mounting national debt anymore, and that could present a problem in the future.

7. Lots of Countries Own U.S. Debt, Especially China & Japan

But who owns all that debt? Two countries stand out among the rest as owning American sovereign debt: China ($1,113B) and Japan ($1,064B). No single other country even comes close to breaking the $500B mark. This means the U.S. is heavily reliant on the good faith of foreign creditors to fuel the American economy.

But who owns all that debt? Two countries stand out among the rest as owning American sovereign debt: China ($1,113B) and Japan ($1,064B). No single other country even comes close to breaking the $500B mark. This means the U.S. is heavily reliant on the good faith of foreign creditors to fuel the American economy.

8. Personal Debt Levels Depend on Where You Live![]()

Speaking of debt, Americans are notorious for living beyond their means. Just how much debt depends on where you live. In fact, Washington, D.C. ($86.7K) has the highest rate of debt per capita in the nation, followed by California ($71.8K). Americans take on debt for all sorts of things, like mortgages, cars, student loans, and consumer debt like credit cards.

9. How do Americans Spend Their Money?

And what do Americans spend all their money on, exactly? On average, the government takes a sizeable chunk of income ($11,394), but not nearly as much as the average cost of housing ($20,091). Americans also spend a sizeable amount on insurance and pensions ($6,831), and relatively little on savings ($6,017).

10. How the Government Gets its Money?

And the government collects revenue from almost everything Americans spend their money on. There are the individual ($392.1M) and corporate ($48.2M) income taxes that come right off the top, followed by general sales taxes ($317.4M). A variety of other types of taxation take place on select items like gasoline ($48.3M), motor vehicle licenses ($27.9M) and property taxes ($20.1M).

What’s missing from our collection of visualizations? What do you want to see us focus on in 2020? Drop us a line in the comments to let us know.

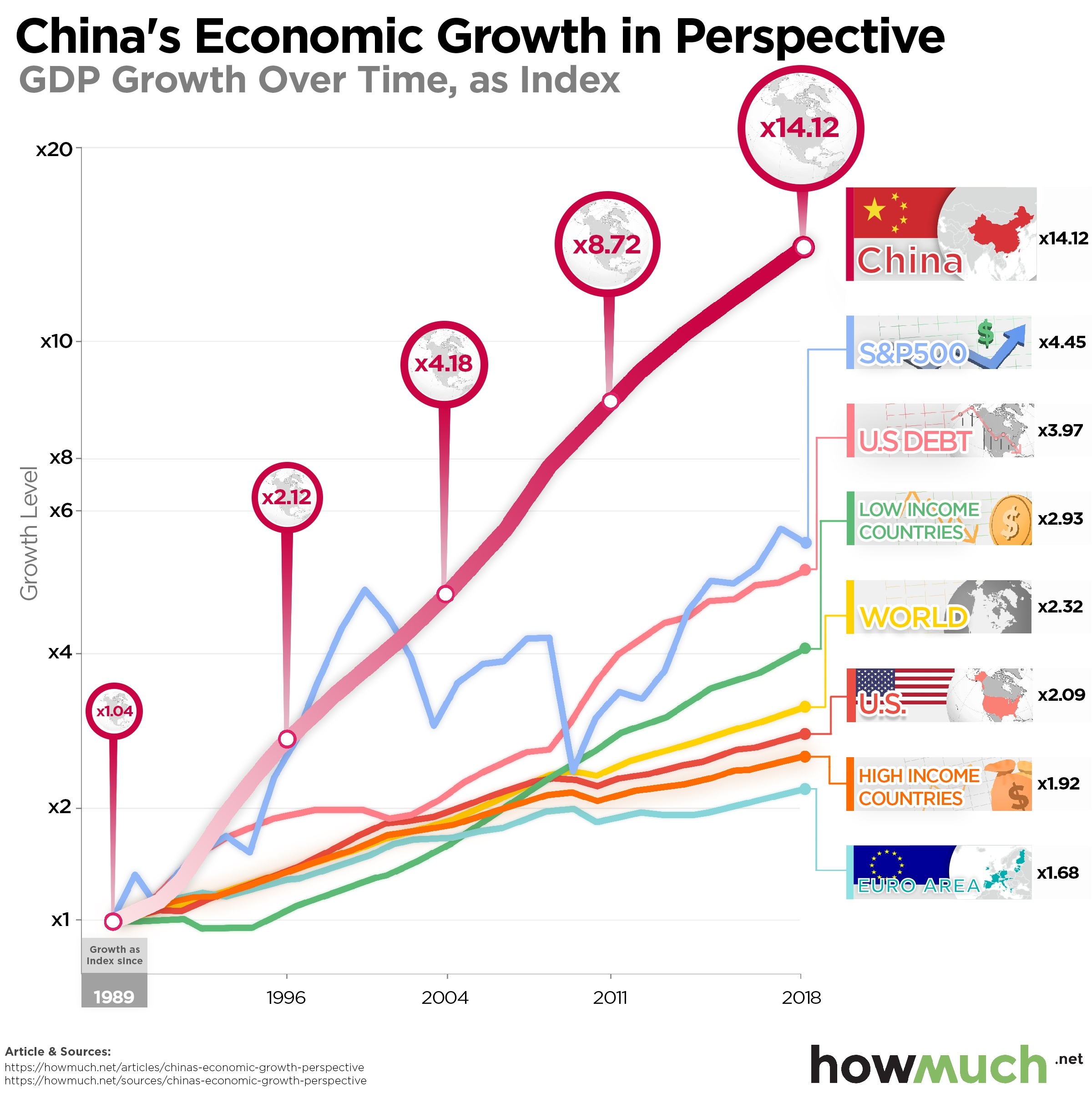

Gross domestic product (GDP) is one of the most widely accepted metrics for comparing the size of economies around the world. This single chart is perhaps the best way to understand just how big the U.S. economy is. Despite all the hype about China, the U.S. is still almost $7 trillion bigger ($13.61T vs. $20.49T).

Gross domestic product (GDP) is one of the most widely accepted metrics for comparing the size of economies around the world. This single chart is perhaps the best way to understand just how big the U.S. economy is. Despite all the hype about China, the U.S. is still almost $7 trillion bigger ($13.61T vs. $20.49T).