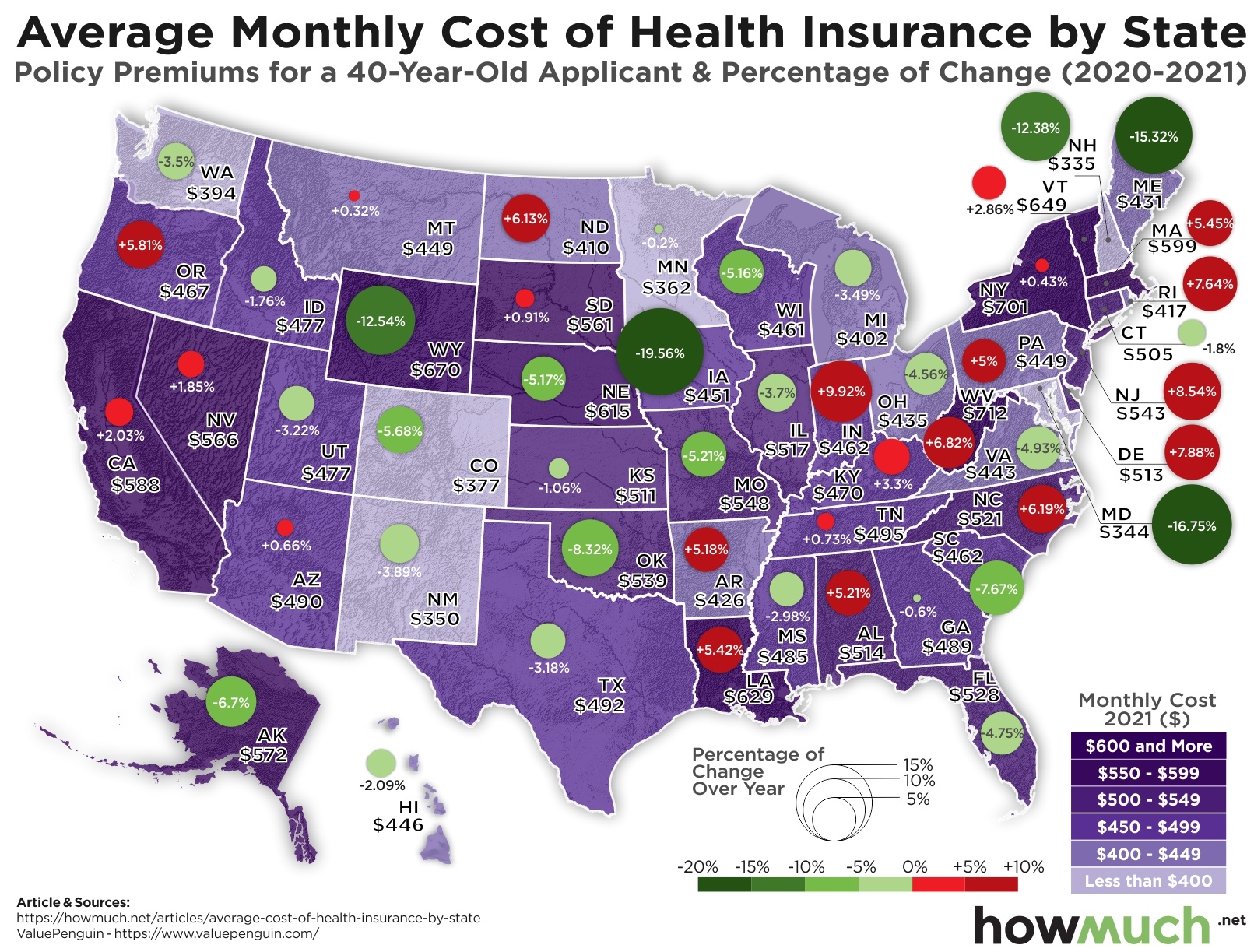

The average cost of health insurance for a typical 40-year-old applicant is about $495 per month, a price that has gone down over 2% from last year. However, health insurance might cost a lot more (or a lot less) depending on where you live.

- West Virginia is the most expensive state in the country for health insurance, costing on average $712 per month.

- The cheapest place is New Hampshire, where insurance only costs about $335 per month for a typical 40-year-old applicant.

- Prices are wildly fluctuating from last year depending on where you live, declining some -19.56% in Iowa but rising +9.92% in Indiana.

- Taken together, health insurance premiums decreased over 2% from last year and cost on average $495.

We got the data for our map thanks to ValuePenguin. First we color-coded each state based on the average monthly cost of health insurance premiums for a 40-year-old applicant. The rates come from Public Use Files at the Centers for Medicare & Medicaid Services. Then, we added a circle corresponding to the percentage of change from 2020 to 2021, with green indicating a net reduction in cost, and red an increase. The result is an intuitive snapshot of the national market for health insurance.

Top 10 Most Expensive States for Health Insurance (And Year-Over-Year Change)

| State | Monthly Cost 2021 | % of Change From 2020 |

|---|---|---|

| 1. West Virginia | $712 | +6.82% |

| 2. New York | $701 | +0.43% |

| 3. Wyoming | $670 | -12.54% |

| 4. Vermont | $649 | +2.86% |

| 5. Louisiana | $629 | +5.42% |

| 6. Nebraska | $615 | -5.17% |

| 7. Massachusetts | $599 | +5.45% |

| 8. California | $588 | +2.03% |

| 9. Alaska | $572 | -6.7% |

| 10. Nevada | $566 | +1.85% |

Our map demonstrates the extent to which geographic location drives pricing for health insurance premiums. The most expensive state is West Virginia, where on average it costs a 40-year-old applicant $712 each month. By contrast, that same applicant would only need to pay $335 in New Hampshire, less than half as much. Not only that, but the price of insurance year-to-year varies across the country too, dropping by almost 20% in Iowa but rising almost 10% in Indiana. The states with the highest populations also tend to see the highest prices, like New York ($701) and California ($588).

What explains the dramatic differences? Why does it cost so much more for health insurance in some states than others? The simplest explanation is that some Americans are healthier than average, and a major factor is location. West Virginia is widely seen as the epicenter for the opioid epidemic, and it is also the most expensive for insurance. By contrast, Colorado has one of the lowest rates of obesity in the U.S., and their health premiums only $377.

There are a few caveats to keep in mind about our visual. The price of health insurance depends on a few different variables, especially the type of plan, the age of the insured, tobacco use, and the number of people being insured. All of these factors go into pricing in addition to physical location. And more importantly, because a lot of people get their health insurance through their employer, most people don’t pay the full price out of their own pocket. Employers usually pay some portion of the premium, which also depends on where you live.

All of which is to say, it pays to shop around for health insurance. If you are in the market for coverage, a good place to start is with our health insurance cost guide.

Data: Table 1.1