The decision to rent or buy your home is one of the biggest in your financial life. But what about the decision to insure it? Renters insurance is often overlooked relative to homeowners insurance, but it’s an important financial product to understand. And, like homeowners insurance, prices for renters insurance vary wildly across the country.

- Americans on average pay $187 annually in renters insurance, with amounts by state ranging from $115 to $244.

- With home prices rising nearly 5% year-over-year, some consumers (especially Millennials) believe they have no choice but to rent.

- The renters’ market is also feeling upward pressure, with the number of high-income renter households rising 45% between 2010 and 2018.

- Despite the booming housing market, advances in technology and artificial intelligence may keep downward pressure on renters insurance prices.

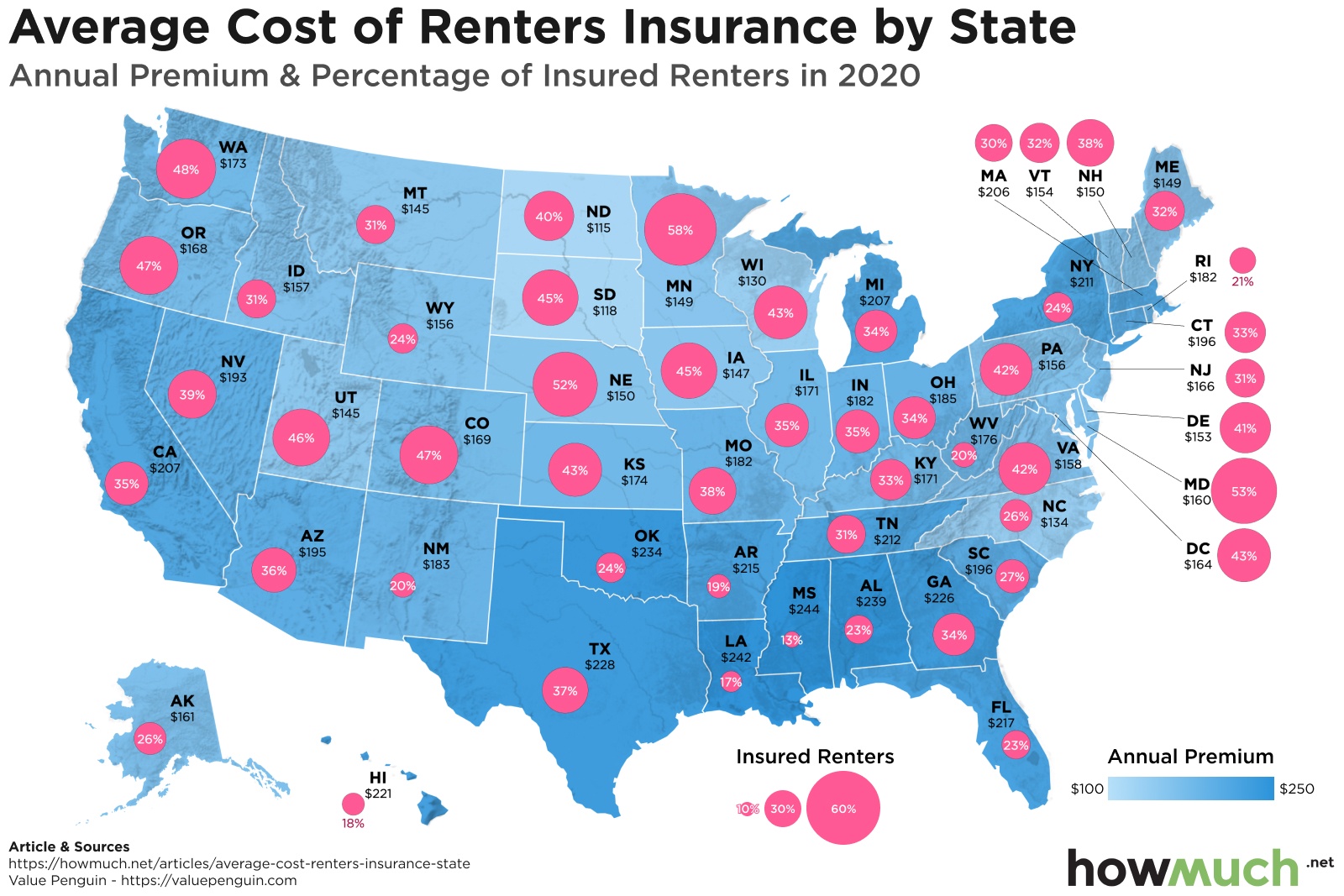

Our data comes from ValuePenguin and includes both the average annual/monthly renters insurance premium and the percent of renters who are insured in that state. For our viz, a darker shade of blue on the map indicates a greater annual premium, and a larger pink circle indicates a larger percentage of insured renters.

Top Ten States with the Highest Renters Insurance

1. Mississippi. Annual premium: $244; percent of insured renters: 13%

2. Louisiana. Annual premium: $242; percent of insured renters: 17%

3. Alabama. Annual premium: $239; percent of insured renters: 23%

4. Oklahoma. Annual premium: $234; percent of insured renters: 24%

5. Texas. Annual premium: $228; percent of insured renters: 37%

6. Georgia. Annual premium: $226; percent of insured renters: 34%

7. Hawaii. Annual premium: $221; percent of insured renters: 18%

8. Florida. Annual premium: $217; percent of insured renters: 23%

9. Arkansas. Annual premium: $215; percent of insured renters: 19%

10. Tennessee. Annual premium: $212; percent of insured renters: 31%

Top Ten States with the Lowest Renters Insurance

1. North Dakota. Annual premium: $115; percent of insured renters: 40%

2. South Dakota. Annual premium: $118; percent of insured renters: 45%

3. Wisconsin. Annual premium: $130; percent of insured renters: 43%

4. North Carolina. Annual premium: $134; percent of insured renters: 26%

5. Utah. Annual premium: $145; percent of insured renters: 46%

6. Montana. Annual premium: $145; percent of insured renters: 31%

7. Iowa. Annual premium: $147; percent of insured renters: 45%

8. Minnesota. Annual premium: $149; percent of insured renters: 58%

9. Maine. Annual premium: $149; percent of insured renters: 32%

10. New Hampshire. Annual premium: $150; percent of insured renters: 38%

A primary determinant of renters insurance is the likelihood of natural disaster: the relatively docile Great Plains and Midwestern states have some of the nation’s lowest premiums. If you really want to save on renters insurance (and spare yourself from a hurricane), consider moving to the Dakotas: North and South have the cheapest on average at $115 and $118 a year, respectively.

By contrast, states with the highest renters insurance include the hurricane-battered Gulf states of Mississippi and Louisiana, and Tornado Alley locales like Oklahoma and Texas. If you’re a renter in these states and disaster does strike, keep in mind that renters are eligible for assistance from the Federal Emergency Management Administration (FEMA). However, this only covers damages from natural disasters and related circumstances, and not events like a burst pipe or a burglary. To learn more about what renters insurance covers, check out our Renters Insurance Guide.

Despite the benefits of renters insurance, the minority of renters have it in all but three states (Minnesota, Maryland and Nebraska). At an average of nearly $200 annually nationwide, it’s not a trivial sum. But will these numbers change with demographic differences and insurance tech breakthroughs?

With a booming housing market, many are rethinking their plan to buy a home. Home prices have been rising nearly 5% year-over-year as of November 2019, and there are over 100,000 fewer homes on the market at the end of 2019 than there were the previous year. With numbers like that, it’s easy to think that renting is the only option -- and this attitude is most common among Millennials, 12% of whom plan to rent forever.

With a crowding-out of would-be homeowners into the rental market, the demographics of renters is also shifting up. The percentage of renter households making $75,000 or more in 2019 hit an all-time high of 22 percent.

So, with rising home prices and rents, do tenants have anything to look forward to? Possibly renters insurance: the insurance market is changing rapidly due to technological advances such as artificial intelligence. Take for example the insurer Lemonade who uses AI to approve coverage for renters insurance in 90 seconds. With lower overhead, Lemonade can pass savings on to consumers. Maybe the ease of use and lower prices will lead more renters to get insured, but it’s unlikely that these relatively small savings will clear a path for increasingly costly home ownership.

Do you prefer to rent or own where you live? If you’re a renter, do you have renter’s insurance? Why or why not? Does anything in the data surprise you? Let us know in the comments and share with your friends.

Data: Table 1.1