Only one out of three Americans actually knows what their monthly budget is. Why is this important? If you always worry about making it to the next paycheck, then it is time to sit down and take a hard look at all your expenses. This can help you decide how much you can afford to spend on things you need to have—like housing and healthcare—and on things you want to have—like new clothes. To get an idea of what this looks like, we created a new visualization for the budget of the typical American making about $75k per year.

Our data comes from the Bureau of Labor Statistics (BLS), a federal agency full of smart economists and math whizzes. They survey Americans every year to understand how we spend our money. The bureaucrats then group expenditures into categories to track how budgets change over time.

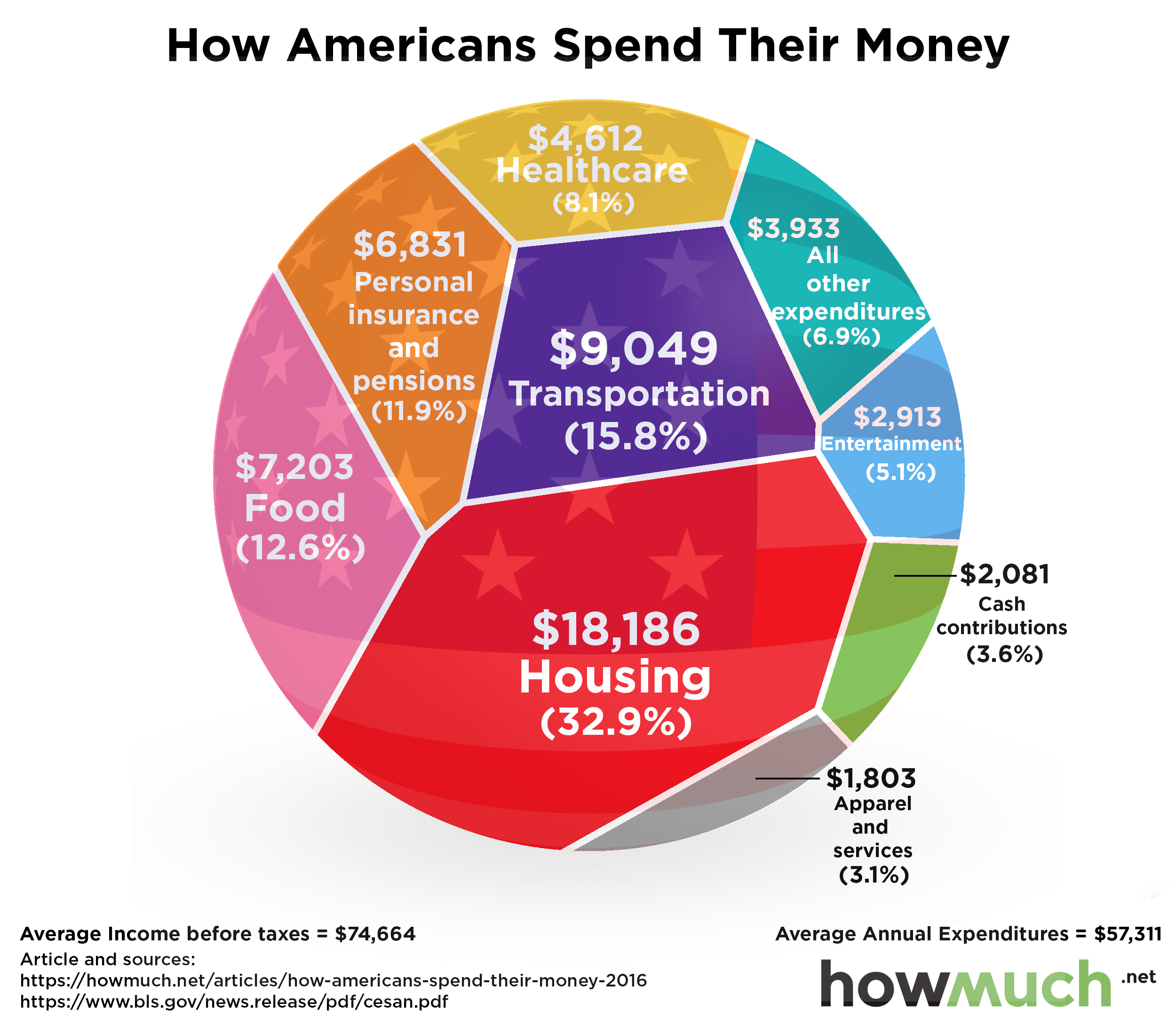

What’s the big takeaway from this data? The BLS calculated an average overall income of $74,664, which is up significantly 7.6% over last year. That’s awesome, but not everyone had such a substantial increase in pay thanks in large part to inequality, but that’s another story. More importantly, although incomes are up 7.6%, spending increased only 2.4%. In an economy driven by consumerism, that’s a recipe for slow growth.

Determining how much money you spend on specific categories can be a real eye-opener for people. By far and away the largest expense is housing, which accounts for almost a third of all expenses. This is a big red flag. According to the federal government, if you spend more than 30% of your income on housing, then you are a greater risk of being unable to afford other necessities. Americans spend more on housing ($18,886) than they do on healthcare, entertainment, clothing, and other miscellaneous expenses combined ($15,342).

So what if you are trying to find ways to trim your own budget? Where should you look? Transportation is the second biggest expense at $9,049. Although it is roughly half the cost of housing, it still comes out to $754 each month. This category includes the down payment spent on your car as well as gas, oil changes, and repairs. Transportation and housing expenses ($27,935) are so high that they are almost as expensive as everything else you buy ($29,376).

If you are serious about finding ways to save money, then take a hard look at your house payment and car note. If you can downsize your home and live closer to work, odds are you will find real savings. Either way, you should definitely figure out your own budget and then stick to it.

Data: Table 1.1