Thank God for the 1%. That much-maligned minority, the richest percent of Americans, pay 39.5% of all Federal Income Tax. That is one of the most eye-catching figures in a study released by the Tax Foundation earlier this month. To put that percentage in absolute figures: the richest percent of American taxpayers pay in $542.64 billion of a total take of Federal Income Tax of $1.37 trillion.

Image may be NSFW.

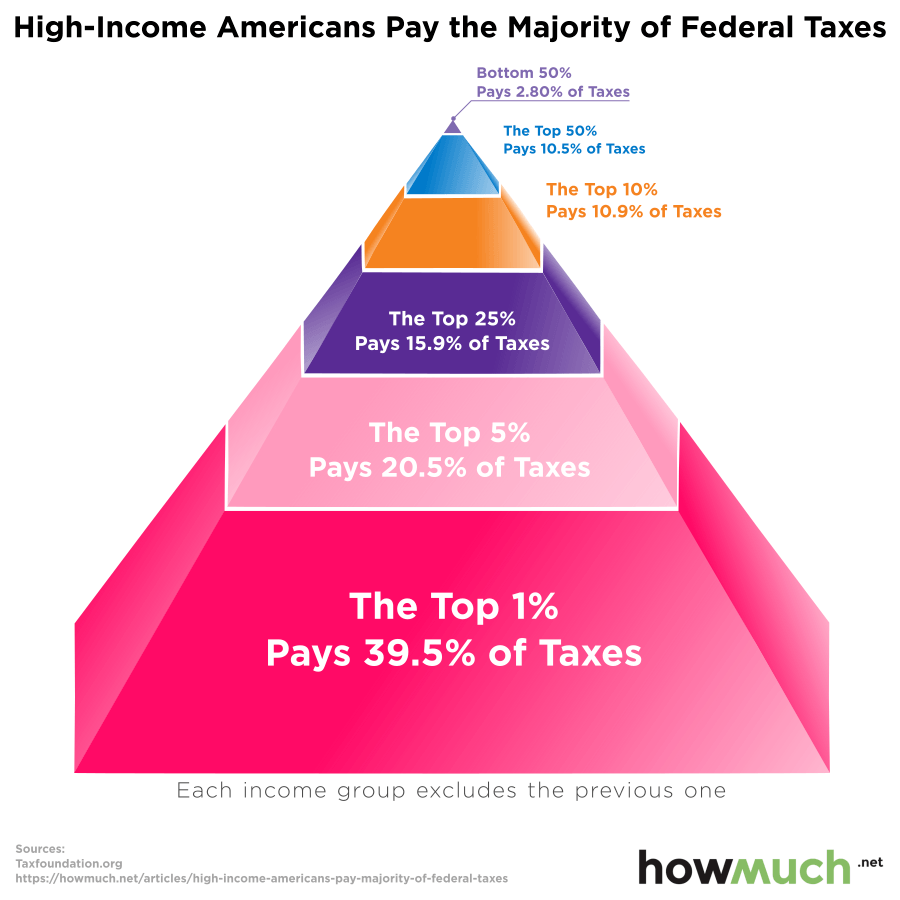

Clik here to view. As this data visualization clearly shows, the top 1% pay much more than taxpayers of any other income level.

As this data visualization clearly shows, the top 1% pay much more than taxpayers of any other income level.

- It is almost double as much as the next bracket of top incomes: those earning the 2% to 5% of the highest wages in America pay 20.5% of all Federal Income Tax. Or in absolute terms: $281.51 billion.

- It is also almost four times as much as those whose incomes range from the top 6% to 10%. They pay 10.9% of Federal Income Tax, or $149.97 billion.

- Those who earn between the top 10% to 25% of wages in America are a much larger group; yet their collective input into the Federal Income Tax is only half as much again as the previous band: 15.9% (i.e. $281.55 billion).

- Those with an income anywhere between the top 25% and 50% only pay 10.5% of all Federal Income Tax, no more than $143.95 billion.

- The entire bottom half of wage earners pays only 2.8% of its income in taxes into the federal coffers. In actual money terms: $37.74 billion. That is more than 14 times less than the top 1%, even though this group is 50 times as numerous.

These figures show the level of contribution to total income tax revenues by the various income levels. The Tax Foundation also provided figures for what that means for individual taxpayers in each group.

- For the richest 1%, the effective average tax rate is 27.2%, meaning that well over a quarter of their income goes into federal coffers.

- For the next group (up to 5%), the fiscal pressure is just below a quarter: 23.6%.

- Taxpayers with incomes in the top 10% part with just over one-fifth (21.3%) of their earnings.

- Those in the top 25% bracket contribute 17.8% of their annual income.

- Even those up to the 50th percentile on average still give 15.5% of their annual income to Uncle Sam.

- Because about 45% of American households make too little to pay any Federal Income Tax, the average percentage for the bottom half of incomes is dramatically lower – the average Federal Income tax level for this group is just 3.5%.

Nobody likes paying taxes, and all taxpayers agree that everyone who contributes to the national purse should have some say in how the government raises and spends its money. But in this debate, whose voice should be louder: that of the majority at the bottom of the income scale (who contribute the least) or of the minority of biggest contributors (who fork out the most)? Simply put, that question is the foundation of all politics in a capitalist democracy like ours.

Sources: Taxfoundation.org